Exercise 1014 Ordinary repairs extraordinary repairs and bet

Exercise 10-14 Ordinary repairs, extraordinary repairs, and betterments LO C3 Oki Company pays $297,400 for equipment expected to last four years and have a $30,000 salvage value. Prepare journal entries to record the following costs related to the equipment 1. During the second year of the equipment\'s life, $18,650 cash is paid for a new component expected to increase the equipment\'s productivity by 10% a year. working order. four to five years. 2. During the third year, $4,663 cash is paid for normal repairs necessary to keep the equipment in good 3. During the fourth year, $11,600 is paid for repairs expected to increase the useful life of the equipment from

Solution

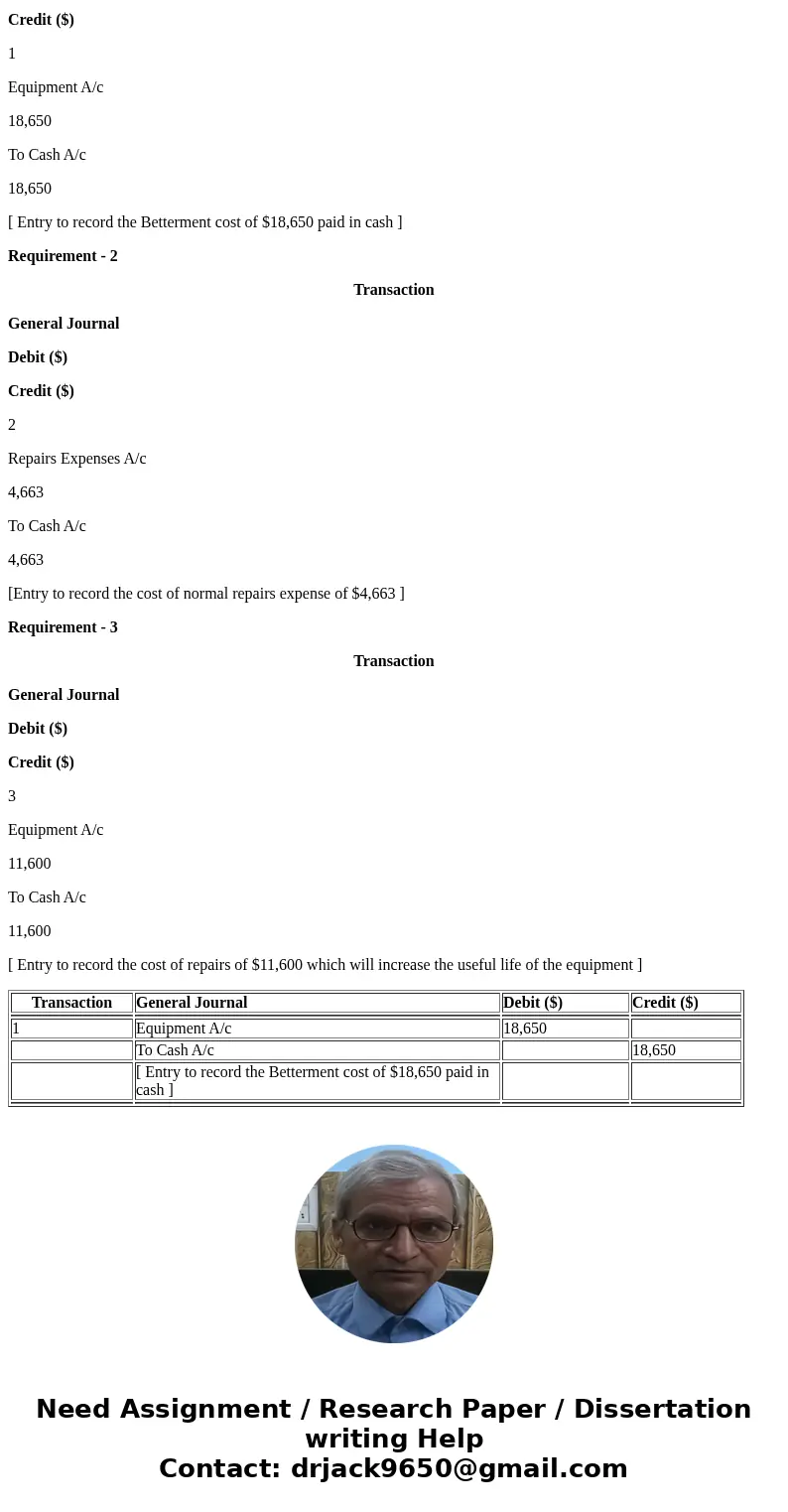

Requirement - 1

Transaction

General Journal

Debit ($)

Credit ($)

1

Equipment A/c

18,650

To Cash A/c

18,650

[ Entry to record the Betterment cost of $18,650 paid in cash ]

Requirement - 2

Transaction

General Journal

Debit ($)

Credit ($)

2

Repairs Expenses A/c

4,663

To Cash A/c

4,663

[Entry to record the cost of normal repairs expense of $4,663 ]

Requirement - 3

Transaction

General Journal

Debit ($)

Credit ($)

3

Equipment A/c

11,600

To Cash A/c

11,600

[ Entry to record the cost of repairs of $11,600 which will increase the useful life of the equipment ]

| Transaction | General Journal | Debit ($) | Credit ($) |

| 1 | Equipment A/c | 18,650 | |

| To Cash A/c | 18,650 | ||

| [ Entry to record the Betterment cost of $18,650 paid in cash ] | |||

Homework Sourse

Homework Sourse