The beforetax income for Novak Co for 2017 was 107000 and 82

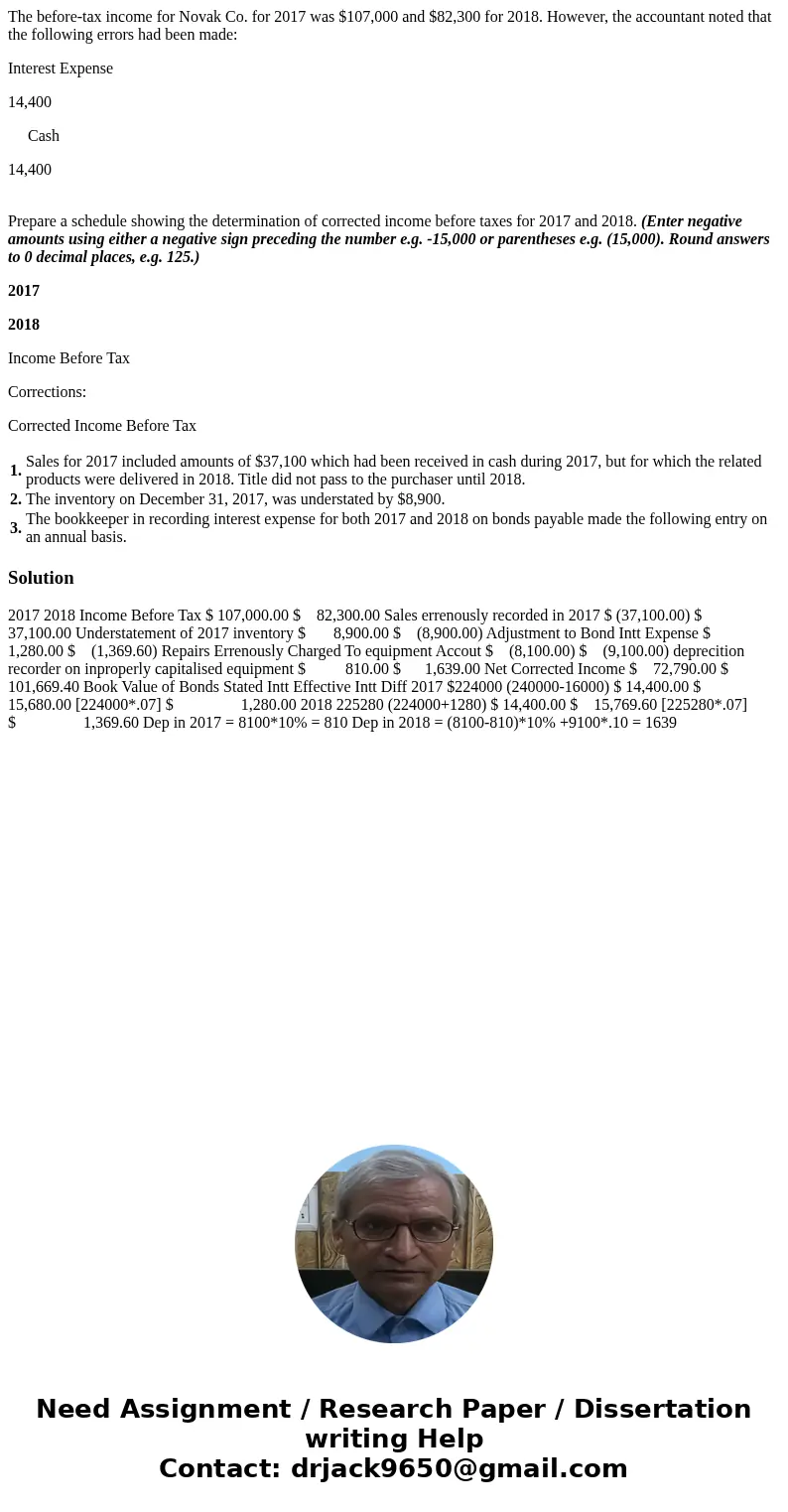

The before-tax income for Novak Co. for 2017 was $107,000 and $82,300 for 2018. However, the accountant noted that the following errors had been made:

Interest Expense

14,400

Cash

14,400

Prepare a schedule showing the determination of corrected income before taxes for 2017 and 2018. (Enter negative amounts using either a negative sign preceding the number e.g. -15,000 or parentheses e.g. (15,000). Round answers to 0 decimal places, e.g. 125.)

2017

2018

Income Before Tax

Corrections:

Corrected Income Before Tax

| 1. | Sales for 2017 included amounts of $37,100 which had been received in cash during 2017, but for which the related products were delivered in 2018. Title did not pass to the purchaser until 2018. | |

| 2. | The inventory on December 31, 2017, was understated by $8,900. | |

| 3. | The bookkeeper in recording interest expense for both 2017 and 2018 on bonds payable made the following entry on an annual basis. |

Solution

2017 2018 Income Before Tax $ 107,000.00 $ 82,300.00 Sales errenously recorded in 2017 $ (37,100.00) $ 37,100.00 Understatement of 2017 inventory $ 8,900.00 $ (8,900.00) Adjustment to Bond Intt Expense $ 1,280.00 $ (1,369.60) Repairs Errenously Charged To equipment Accout $ (8,100.00) $ (9,100.00) deprecition recorder on inproperly capitalised equipment $ 810.00 $ 1,639.00 Net Corrected Income $ 72,790.00 $ 101,669.40 Book Value of Bonds Stated Intt Effective Intt Diff 2017 $224000 (240000-16000) $ 14,400.00 $ 15,680.00 [224000*.07] $ 1,280.00 2018 225280 (224000+1280) $ 14,400.00 $ 15,769.60 [225280*.07] $ 1,369.60 Dep in 2017 = 8100*10% = 810 Dep in 2018 = (8100-810)*10% +9100*.10 = 1639

Homework Sourse

Homework Sourse