Updates Not Installed O A Some updates could not be i thtml

Updates Not Installed . O A Some updates could not be i t.html Help Save&Exit; 5 Problem 8-31 Completing a Master Budget [LO8-2, L08-4, LO8-7, LO8-8, LO8-9, LO8-10) Hillyard Company, an office supplies specialty store, prepares its master budget on a quarterly basis. The following data have been assembled to assist in preparing the master budget for the first quarter: 10 a. As of December 31 (the end of the prior quarter), the company\'s general ledger showed the following account balances: 62,000 217,600 61,050 372,000 Print Inventory 91,725 500,000 120,925 payable Common stock $ 712,650 712,650 b. Actual sales for December and budgeted sales for the next four months are as follows: $272,000 January February $407,000 $604,000 $319,000

Solution

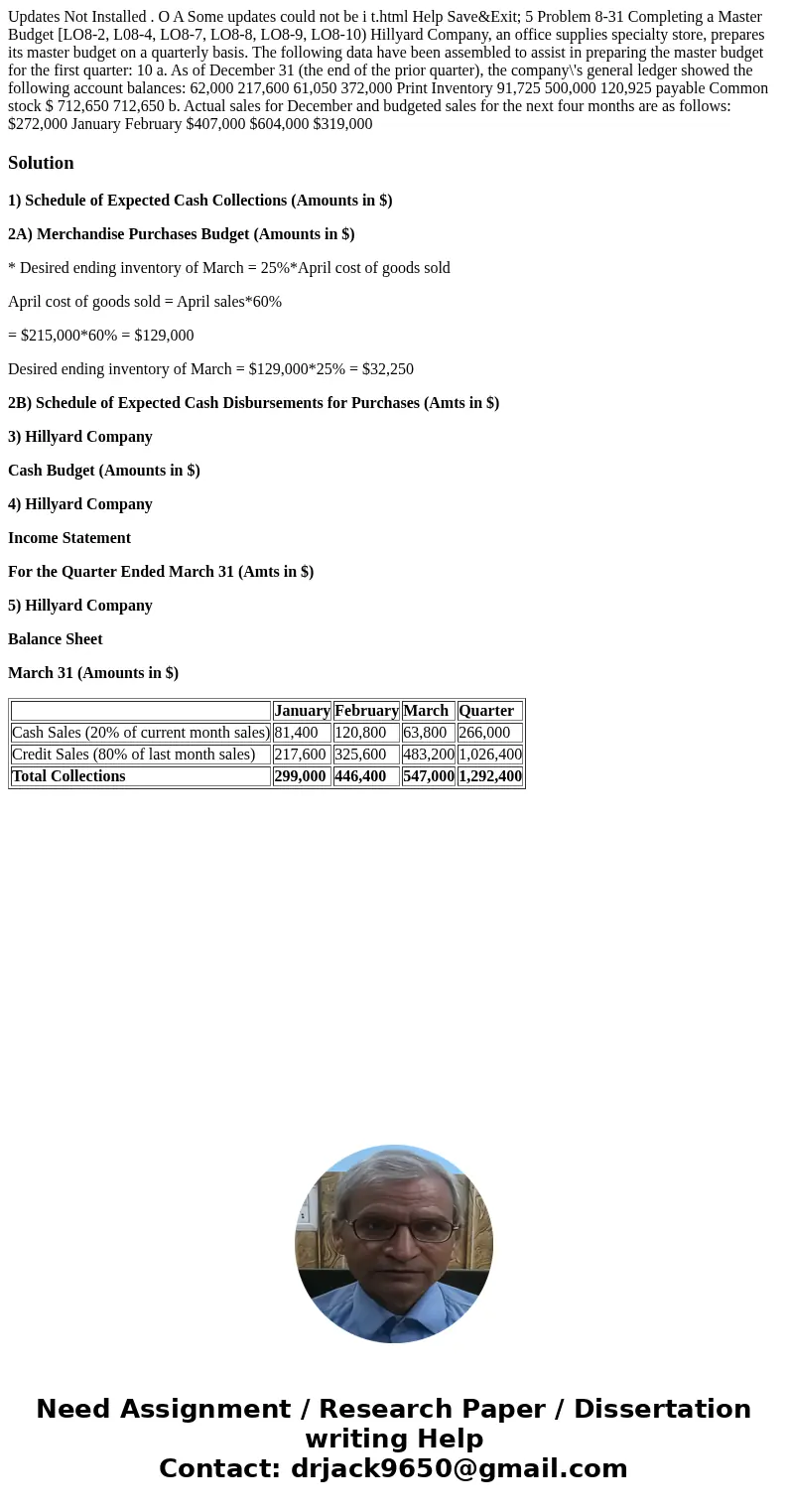

1) Schedule of Expected Cash Collections (Amounts in $)

2A) Merchandise Purchases Budget (Amounts in $)

* Desired ending inventory of March = 25%*April cost of goods sold

April cost of goods sold = April sales*60%

= $215,000*60% = $129,000

Desired ending inventory of March = $129,000*25% = $32,250

2B) Schedule of Expected Cash Disbursements for Purchases (Amts in $)

3) Hillyard Company

Cash Budget (Amounts in $)

4) Hillyard Company

Income Statement

For the Quarter Ended March 31 (Amts in $)

5) Hillyard Company

Balance Sheet

March 31 (Amounts in $)

| January | February | March | Quarter | |

| Cash Sales (20% of current month sales) | 81,400 | 120,800 | 63,800 | 266,000 |

| Credit Sales (80% of last month sales) | 217,600 | 325,600 | 483,200 | 1,026,400 |

| Total Collections | 299,000 | 446,400 | 547,000 | 1,292,400 |

Homework Sourse

Homework Sourse