Exercise 91 Blue Spruce Industries is considering the purcha

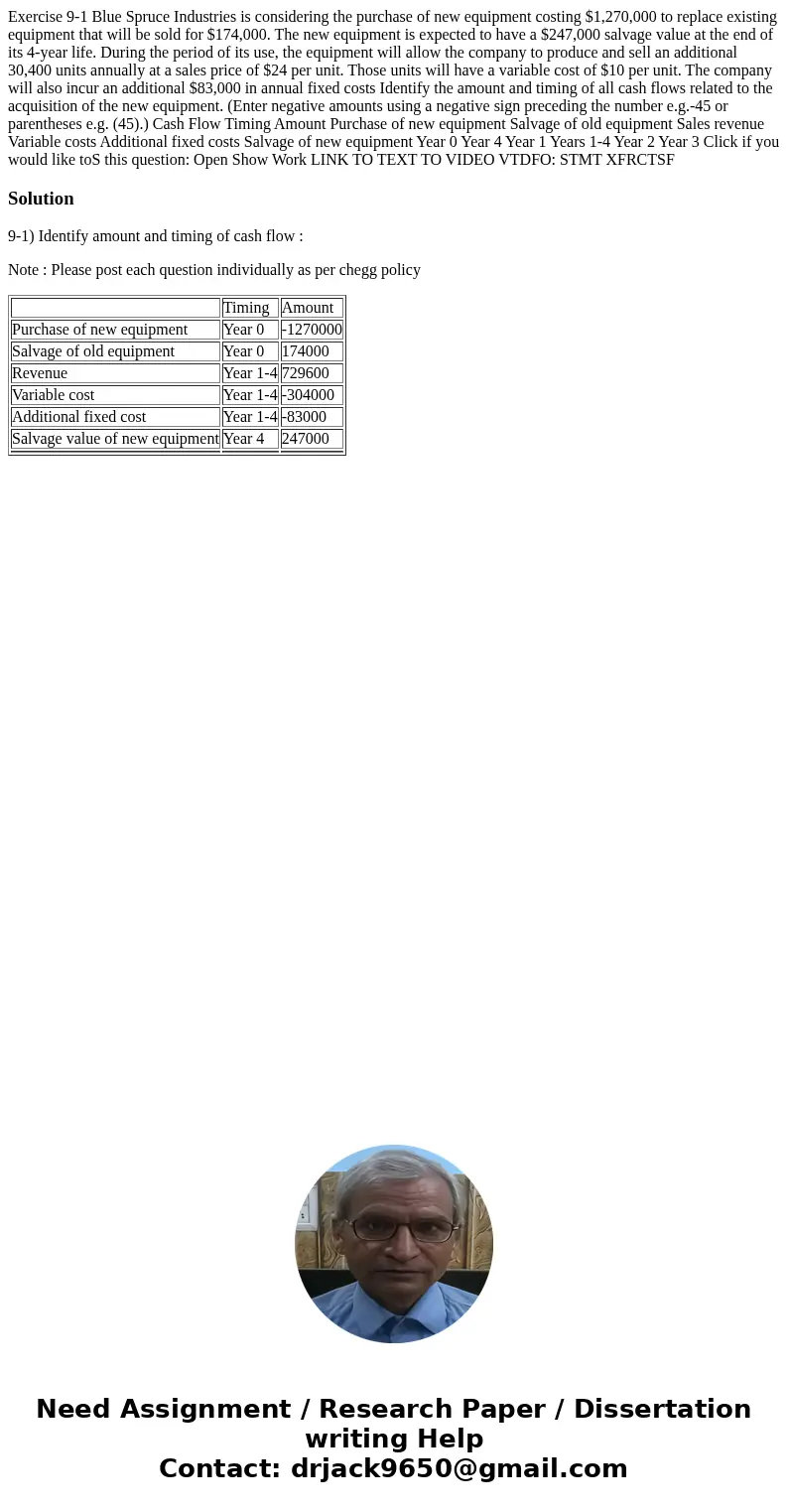

Exercise 9-1 Blue Spruce Industries is considering the purchase of new equipment costing $1,270,000 to replace existing equipment that will be sold for $174,000. The new equipment is expected to have a $247,000 salvage value at the end of its 4-year life. During the period of its use, the equipment will allow the company to produce and sell an additional 30,400 units annually at a sales price of $24 per unit. Those units will have a variable cost of $10 per unit. The company will also incur an additional $83,000 in annual fixed costs Identify the amount and timing of all cash flows related to the acquisition of the new equipment. (Enter negative amounts using a negative sign preceding the number e.g.-45 or parentheses e.g. (45).) Cash Flow Timing Amount Purchase of new equipment Salvage of old equipment Sales revenue Variable costs Additional fixed costs Salvage of new equipment Year 0 Year 4 Year 1 Years 1-4 Year 2 Year 3 Click if you would like toS this question: Open Show Work LINK TO TEXT TO VIDEO VTDFO: STMT XFRCTSF

Solution

9-1) Identify amount and timing of cash flow :

Note : Please post each question individually as per chegg policy

| Timing | Amount | |

| Purchase of new equipment | Year 0 | -1270000 |

| Salvage of old equipment | Year 0 | 174000 |

| Revenue | Year 1-4 | 729600 |

| Variable cost | Year 1-4 | -304000 |

| Additional fixed cost | Year 1-4 | -83000 |

| Salvage value of new equipment | Year 4 | 247000 |

Homework Sourse

Homework Sourse