Woolard Inc has taxable income in 2017 of 150000 before any

Woolard Inc. has taxable income in 2017 of $150,000 before any depreciation deductions (5179, bonus, or MACRS) and acquired the following assets during the year: (Use MACRS Table 1, Table 2, Table 3, Table 4 and Table 5.) (Do not round intermediate calculations. Round your answers to the nearest whole dollar amount.) Placed In Asset serviceBasis Office furniture (used March 20 600,000 b. If Woolard elects the maximum amount of 5179 for the year, what is the amount of deductible §179 expense for the year? what is the total depreciation expense that Woolard may deduct in 2017? What is Woolard\'s 5179 carryfoward amount to next year, if any? Answer is complete but not entirely correct. Deductible $179 35,710 150,000? 364,290 Total depreciation ex Se $179 carryforward

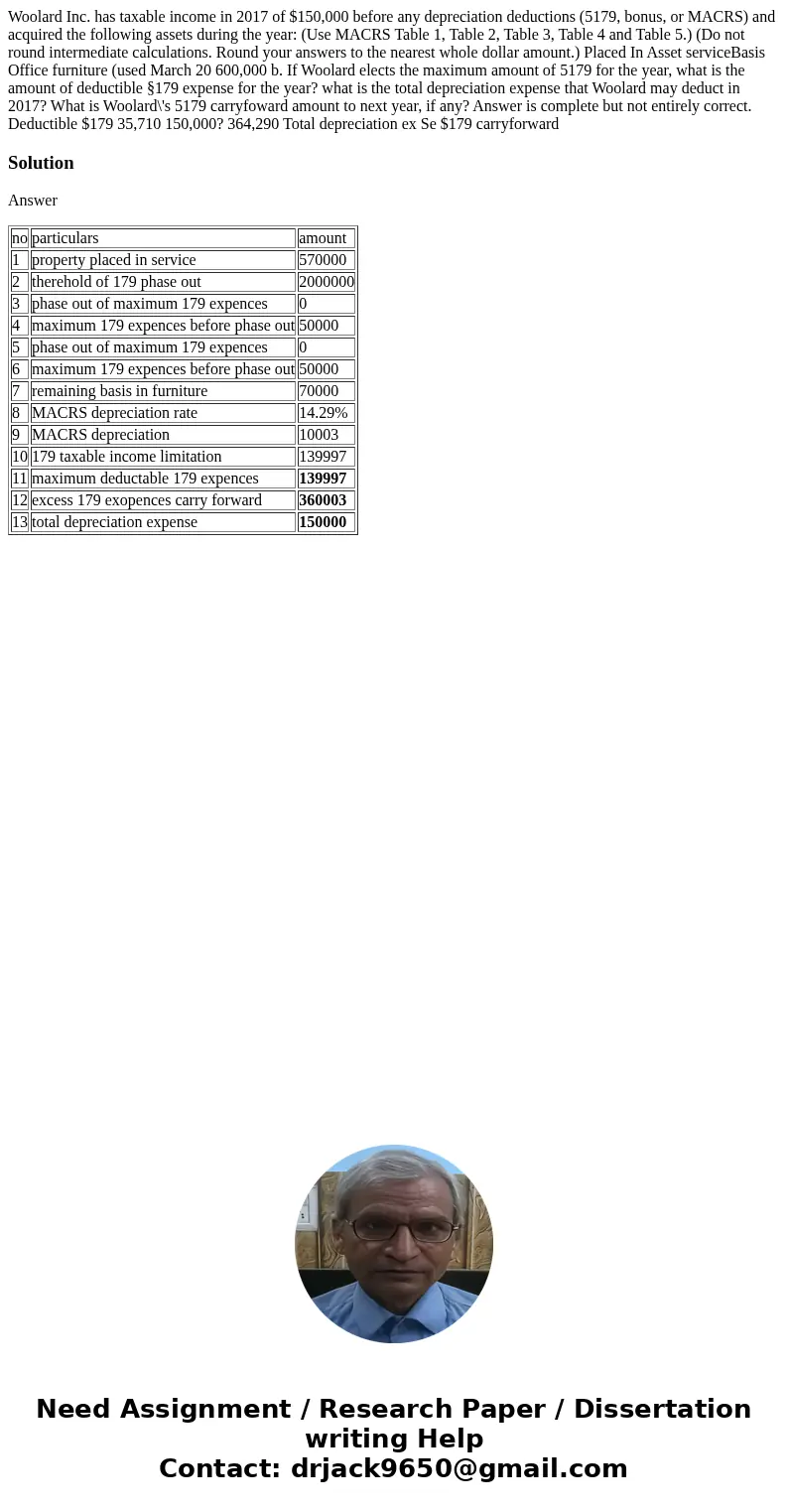

Solution

Answer

| no | particulars | amount |

| 1 | property placed in service | 570000 |

| 2 | therehold of 179 phase out | 2000000 |

| 3 | phase out of maximum 179 expences | 0 |

| 4 | maximum 179 expences before phase out | 50000 |

| 5 | phase out of maximum 179 expences | 0 |

| 6 | maximum 179 expences before phase out | 50000 |

| 7 | remaining basis in furniture | 70000 |

| 8 | MACRS depreciation rate | 14.29% |

| 9 | MACRS depreciation | 10003 |

| 10 | 179 taxable income limitation | 139997 |

| 11 | maximum deductable 179 expences | 139997 |

| 12 | excess 179 exopences carry forward | 360003 |

| 13 | total depreciation expense | 150000 |

Homework Sourse

Homework Sourse