Help I have tried and tried and cant figure this one out Use

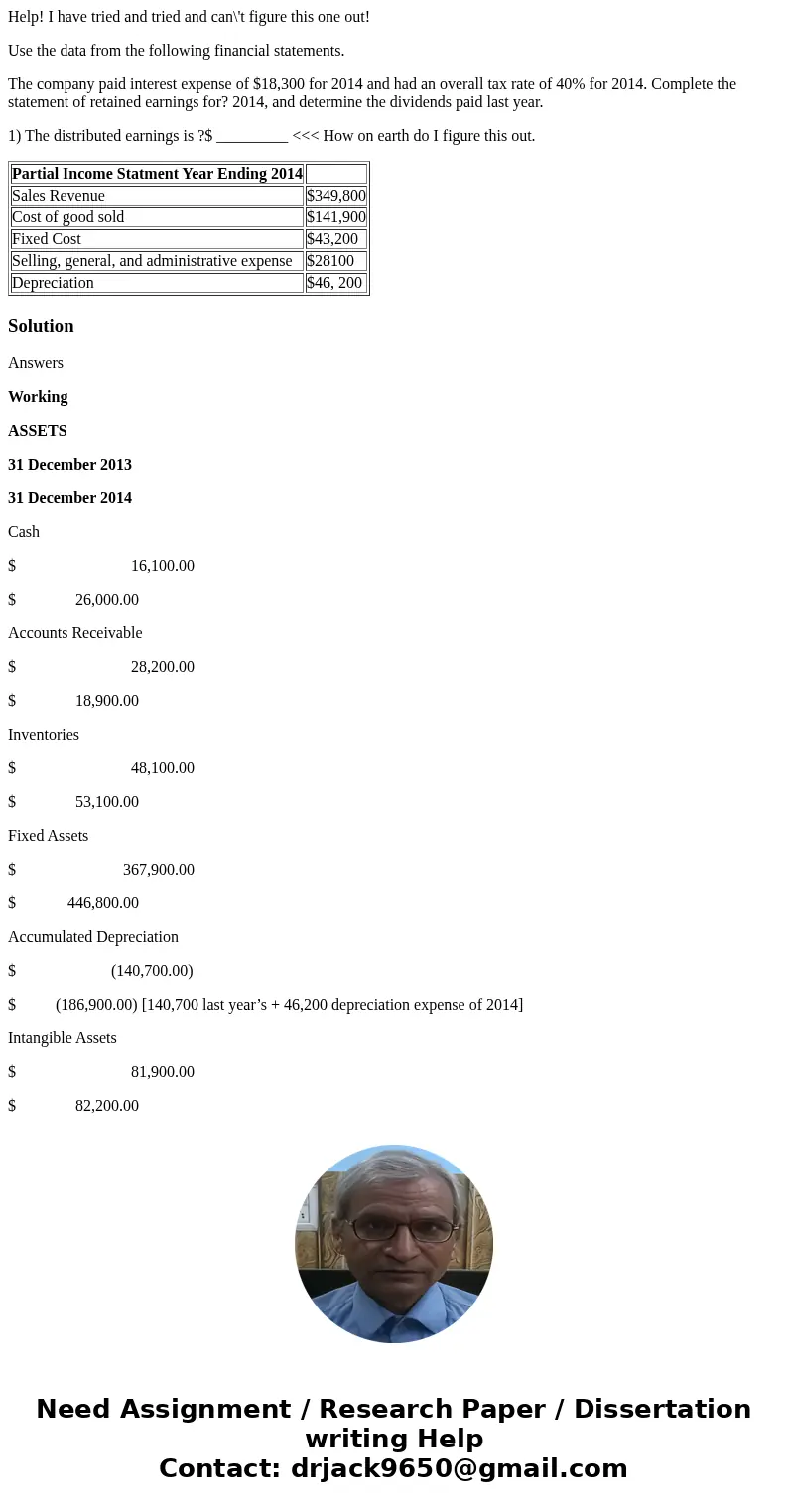

Help! I have tried and tried and can\'t figure this one out!

Use the data from the following financial statements.

The company paid interest expense of $18,300 for 2014 and had an overall tax rate of 40% for 2014. Complete the statement of retained earnings for? 2014, and determine the dividends paid last year.

1) The distributed earnings is ?$ _________ <<< How on earth do I figure this out.

| Partial Income Statment Year Ending 2014 | |

|---|---|

| Sales Revenue | $349,800 |

| Cost of good sold | $141,900 |

| Fixed Cost | $43,200 |

| Selling, general, and administrative expense | $28100 |

| Depreciation | $46, 200 |

Solution

Answers

Working

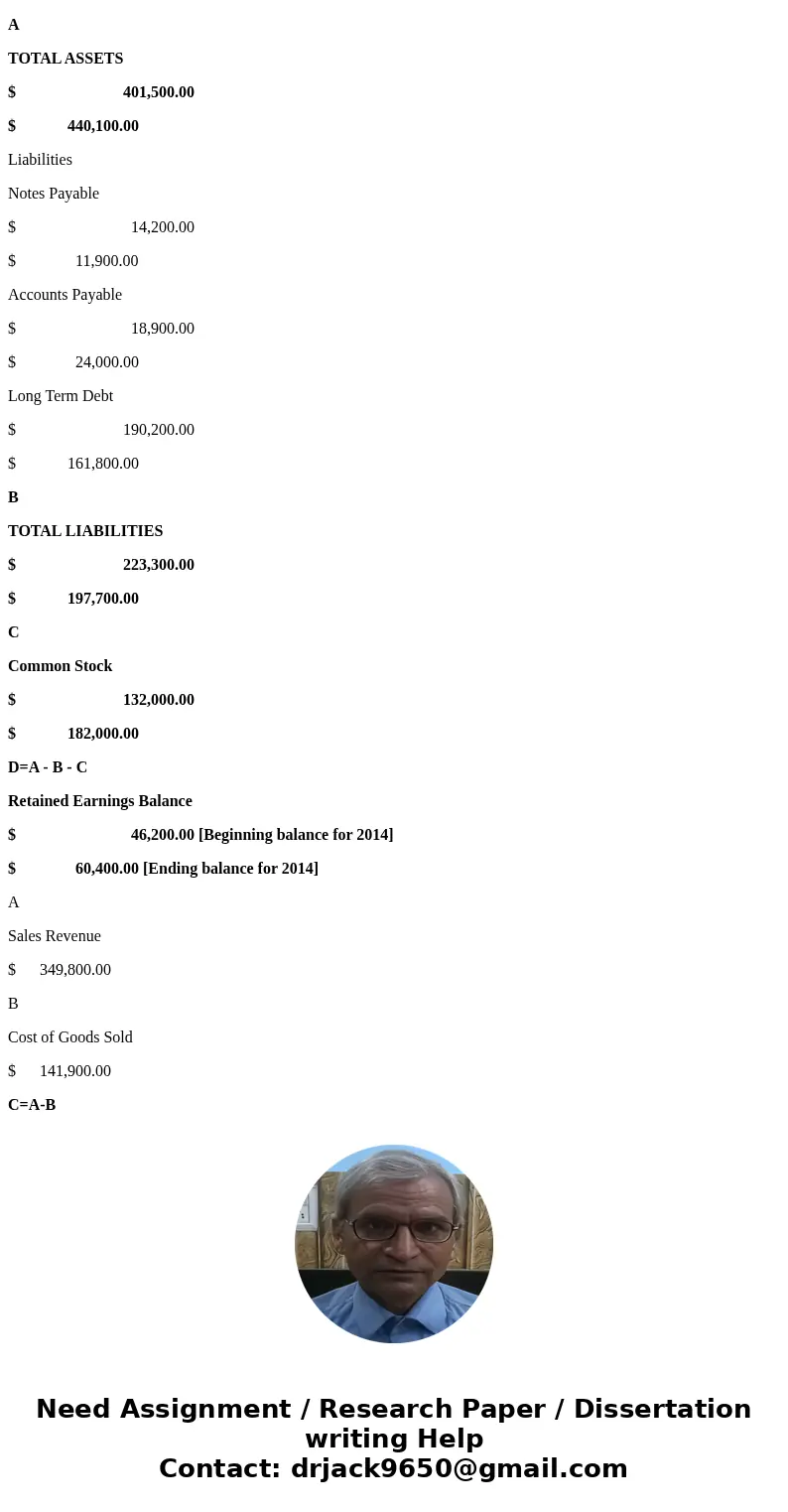

ASSETS

31 December 2013

31 December 2014

Cash

$ 16,100.00

$ 26,000.00

Accounts Receivable

$ 28,200.00

$ 18,900.00

Inventories

$ 48,100.00

$ 53,100.00

Fixed Assets

$ 367,900.00

$ 446,800.00

Accumulated Depreciation

$ (140,700.00)

$ (186,900.00) [140,700 last year’s + 46,200 depreciation expense of 2014]

Intangible Assets

$ 81,900.00

$ 82,200.00

A

TOTAL ASSETS

$ 401,500.00

$ 440,100.00

Liabilities

Notes Payable

$ 14,200.00

$ 11,900.00

Accounts Payable

$ 18,900.00

$ 24,000.00

Long Term Debt

$ 190,200.00

$ 161,800.00

B

TOTAL LIABILITIES

$ 223,300.00

$ 197,700.00

C

Common Stock

$ 132,000.00

$ 182,000.00

D=A - B - C

Retained Earnings Balance

$ 46,200.00 [Beginning balance for 2014]

$ 60,400.00 [Ending balance for 2014]

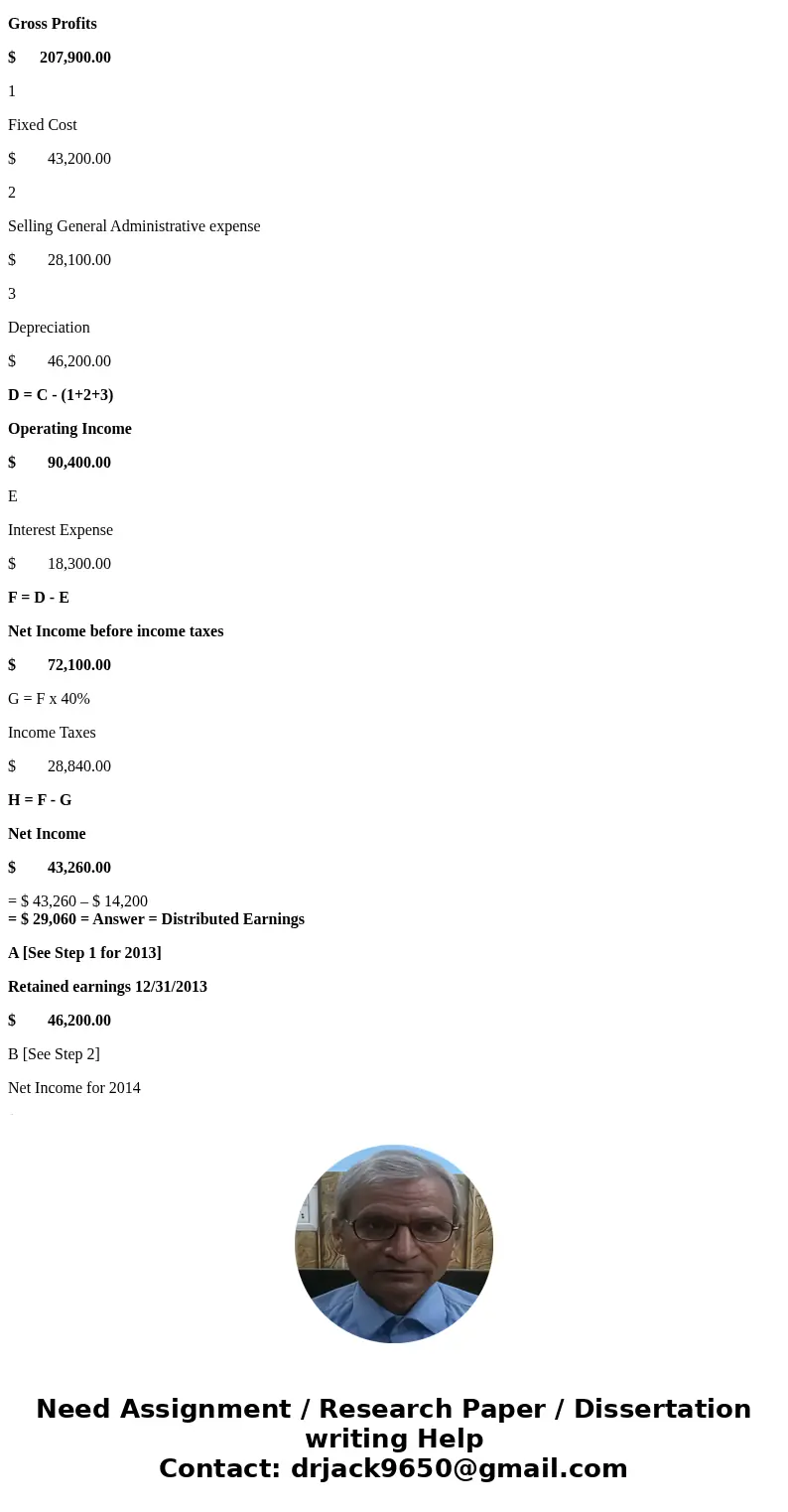

A

Sales Revenue

$ 349,800.00

B

Cost of Goods Sold

$ 141,900.00

C=A-B

Gross Profits

$ 207,900.00

1

Fixed Cost

$ 43,200.00

2

Selling General Administrative expense

$ 28,100.00

3

Depreciation

$ 46,200.00

D = C - (1+2+3)

Operating Income

$ 90,400.00

E

Interest Expense

$ 18,300.00

F = D - E

Net Income before income taxes

$ 72,100.00

G = F x 40%

Income Taxes

$ 28,840.00

H = F - G

Net Income

$ 43,260.00

= $ 43,260 – $ 14,200

= $ 29,060 = Answer = Distributed Earnings

A [See Step 1 for 2013]

Retained earnings 12/31/2013

$ 46,200.00

B [See Step 2]

Net Income for 2014

$ 43,260.00

C=A+B

Total

$ 89,460.00

D [See Step 1 for 2014]

Retained Earnings as calculated for 12/31/2014

$ 60,400.00

E = C - D

Distributed Earnings

$ 29,060.00

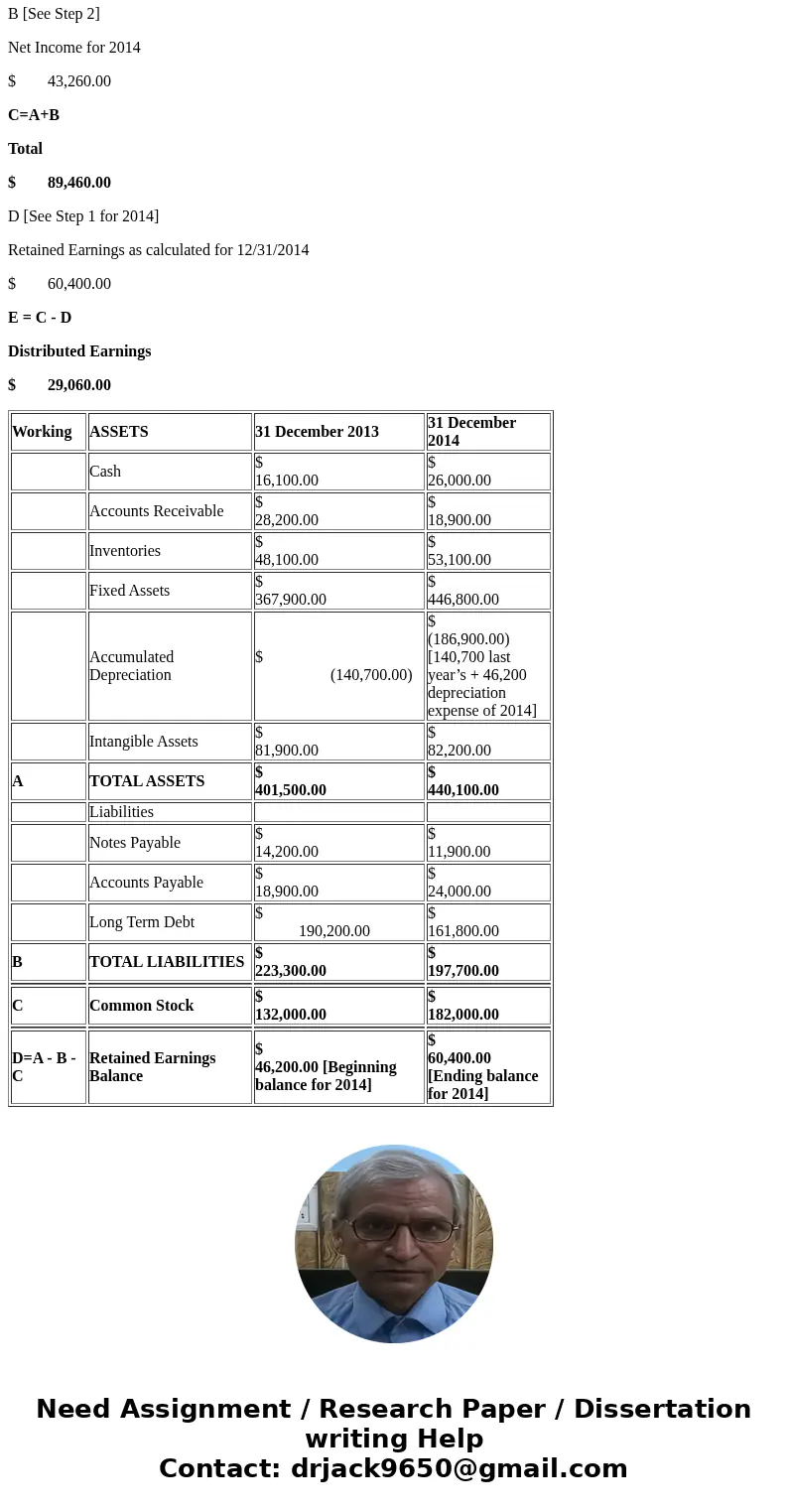

| Working | ASSETS | 31 December 2013 | 31 December 2014 |

| Cash | $ 16,100.00 | $ 26,000.00 | |

| Accounts Receivable | $ 28,200.00 | $ 18,900.00 | |

| Inventories | $ 48,100.00 | $ 53,100.00 | |

| Fixed Assets | $ 367,900.00 | $ 446,800.00 | |

| Accumulated Depreciation | $ (140,700.00) | $ (186,900.00) [140,700 last year’s + 46,200 depreciation expense of 2014] | |

| Intangible Assets | $ 81,900.00 | $ 82,200.00 | |

| A | TOTAL ASSETS | $ 401,500.00 | $ 440,100.00 |

| Liabilities | |||

| Notes Payable | $ 14,200.00 | $ 11,900.00 | |

| Accounts Payable | $ 18,900.00 | $ 24,000.00 | |

| Long Term Debt | $ 190,200.00 | $ 161,800.00 | |

| B | TOTAL LIABILITIES | $ 223,300.00 | $ 197,700.00 |

| C | Common Stock | $ 132,000.00 | $ 182,000.00 |

| D=A - B - C | Retained Earnings Balance | $ 46,200.00 [Beginning balance for 2014] | $ 60,400.00 [Ending balance for 2014] |

Homework Sourse

Homework Sourse