On January 2 2018 Gold Star Leasing Company leases equipment

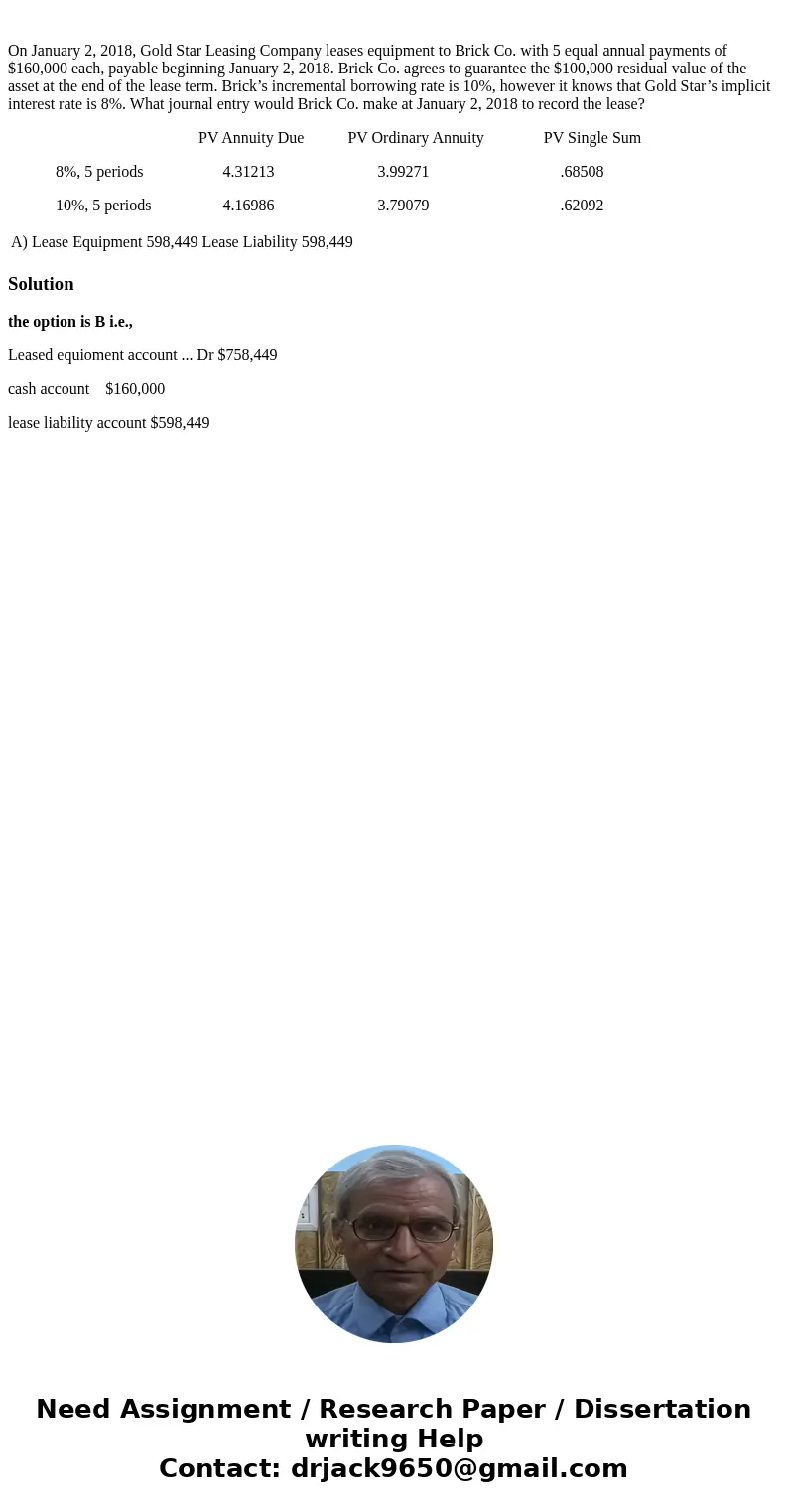

On January 2, 2018, Gold Star Leasing Company leases equipment to Brick Co. with 5 equal annual payments of $160,000 each, payable beginning January 2, 2018. Brick Co. agrees to guarantee the $100,000 residual value of the asset at the end of the lease term. Brick’s incremental borrowing rate is 10%, however it knows that Gold Star’s implicit interest rate is 8%. What journal entry would Brick Co. make at January 2, 2018 to record the lease?

PV Annuity Due PV Ordinary Annuity PV Single Sum

8%, 5 periods 4.31213 3.99271 .68508

10%, 5 periods 4.16986 3.79079 .62092

| A) | Lease Equipment 598,449 Lease Liability 598,449 |

Solution

the option is B i.e.,

Leased equioment account ... Dr $758,449

cash account $160,000

lease liability account $598,449

Homework Sourse

Homework Sourse