Exercise 41 5 9 13 10 14 2 7 15 12 16 SolutionNo Accounts Cl

Solution

No

Accounts

Classification of Accounts

1

Roberta Jefferson Withdrawals

Debit Column for the Balance sheet and Statement for Changes in Equity

2

Interest Income

Credit Column for the income Statement

3

Accumulated Depreciation-Machinery

Credit Column for the Balance sheet and Statement for Changes in Equity

4

Service Revenue

Credit Column for the income Statement

5

Accounts receivables

Debit Column for the Balance sheet and Statement for Changes in Equity

6

Rent Expenses

Debit Column for the income Statement

7

depreciation expenses Machinery

Debit Column for the income Statement

8

Accounts Payable

Credit Column for the Balance sheet and Statement for Changes in Equity

9

Cash

Debit Column for the Balance sheet and Statement for Changes in Equity

10

Office Supplies

Debit Column for the Balance sheet and Statement for Changes in Equity

11

Roberta Jefferson Capital

Credit Column for the Balance sheet and Statement for Changes in Equity

12

Wages Payable

Credit Column for the Balance sheet and Statement for Changes in Equity

13

Machinery

Debit Column for the Balance sheet and Statement for Changes in Equity

14

Insurance expenses

Debit Column for the income Statement

15

Interest expenses

Debit Column for the income Statement

16

Interest Receivable

Debit Column for the Balance sheet and Statement for Changes in Equity

Aacounting Equation

Assets=

Liabilities+

Owner\'s Equity

Capital-

Withdrawls+

Income-

Expenses

Accounts receivables

Accounts Payable

Roberta Jefferson Capital

Roberta Jefferson Withdrawls

Interest Income

Rent Expenses

Cash

Wages Payable

Service Revenue

depreciation expenses Machinery

Office Supplies

Accumulated Depreciation-Machinery

Insurance expenses

Machinery

Interest expenses

Interest Receivable

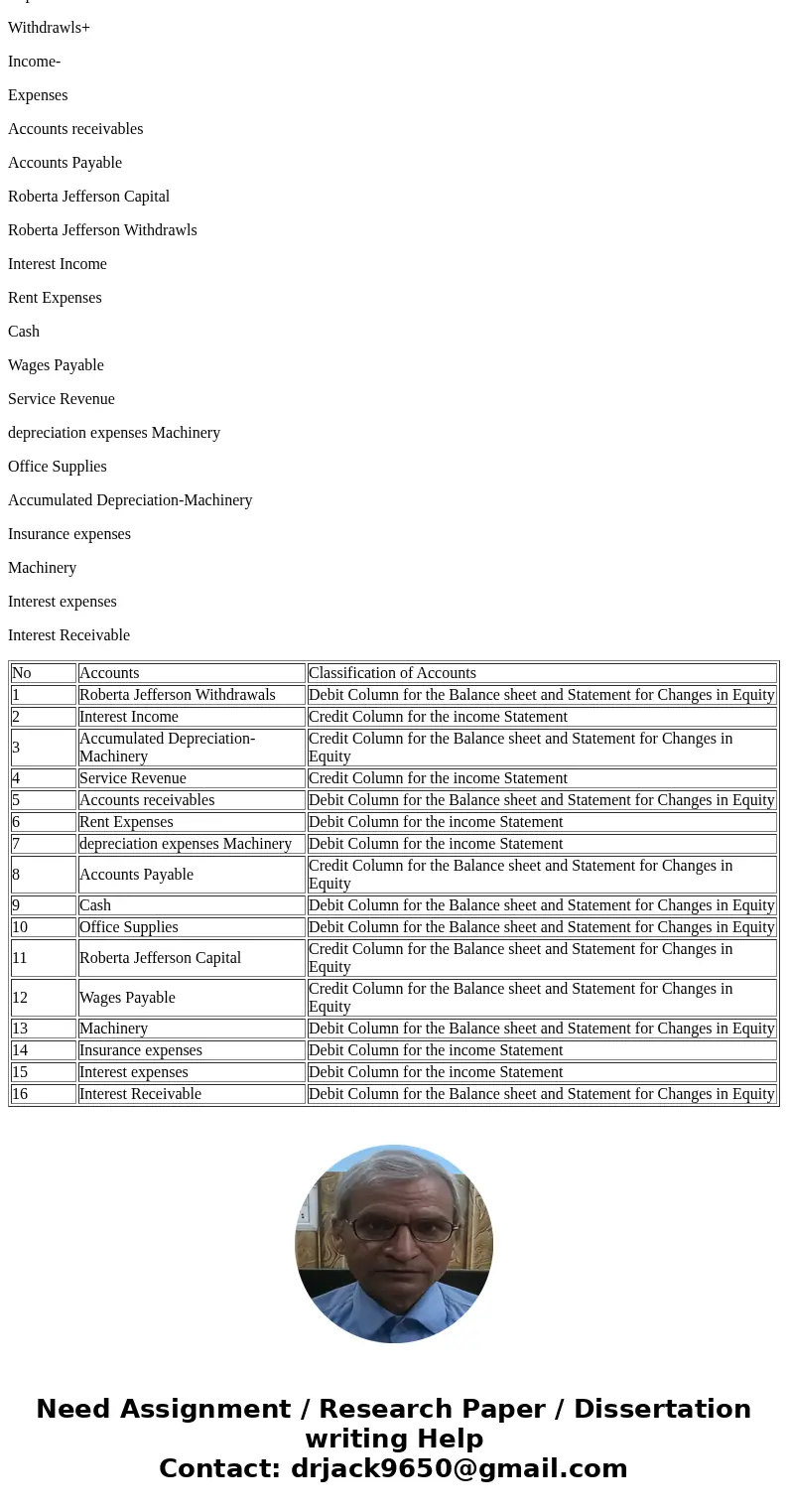

| No | Accounts | Classification of Accounts |

| 1 | Roberta Jefferson Withdrawals | Debit Column for the Balance sheet and Statement for Changes in Equity |

| 2 | Interest Income | Credit Column for the income Statement |

| 3 | Accumulated Depreciation-Machinery | Credit Column for the Balance sheet and Statement for Changes in Equity |

| 4 | Service Revenue | Credit Column for the income Statement |

| 5 | Accounts receivables | Debit Column for the Balance sheet and Statement for Changes in Equity |

| 6 | Rent Expenses | Debit Column for the income Statement |

| 7 | depreciation expenses Machinery | Debit Column for the income Statement |

| 8 | Accounts Payable | Credit Column for the Balance sheet and Statement for Changes in Equity |

| 9 | Cash | Debit Column for the Balance sheet and Statement for Changes in Equity |

| 10 | Office Supplies | Debit Column for the Balance sheet and Statement for Changes in Equity |

| 11 | Roberta Jefferson Capital | Credit Column for the Balance sheet and Statement for Changes in Equity |

| 12 | Wages Payable | Credit Column for the Balance sheet and Statement for Changes in Equity |

| 13 | Machinery | Debit Column for the Balance sheet and Statement for Changes in Equity |

| 14 | Insurance expenses | Debit Column for the income Statement |

| 15 | Interest expenses | Debit Column for the income Statement |

| 16 | Interest Receivable | Debit Column for the Balance sheet and Statement for Changes in Equity |

Homework Sourse

Homework Sourse