Problems 5 points The money velocity rate is 4 times the tur

Problems:

(5 points) The money velocity rate is 4 times, the turnover period is 45 days. Find the economy monetization level.

(5 points) The Consumer Price Index increased by 7.6% over the past two years. How has the money buying power changed?

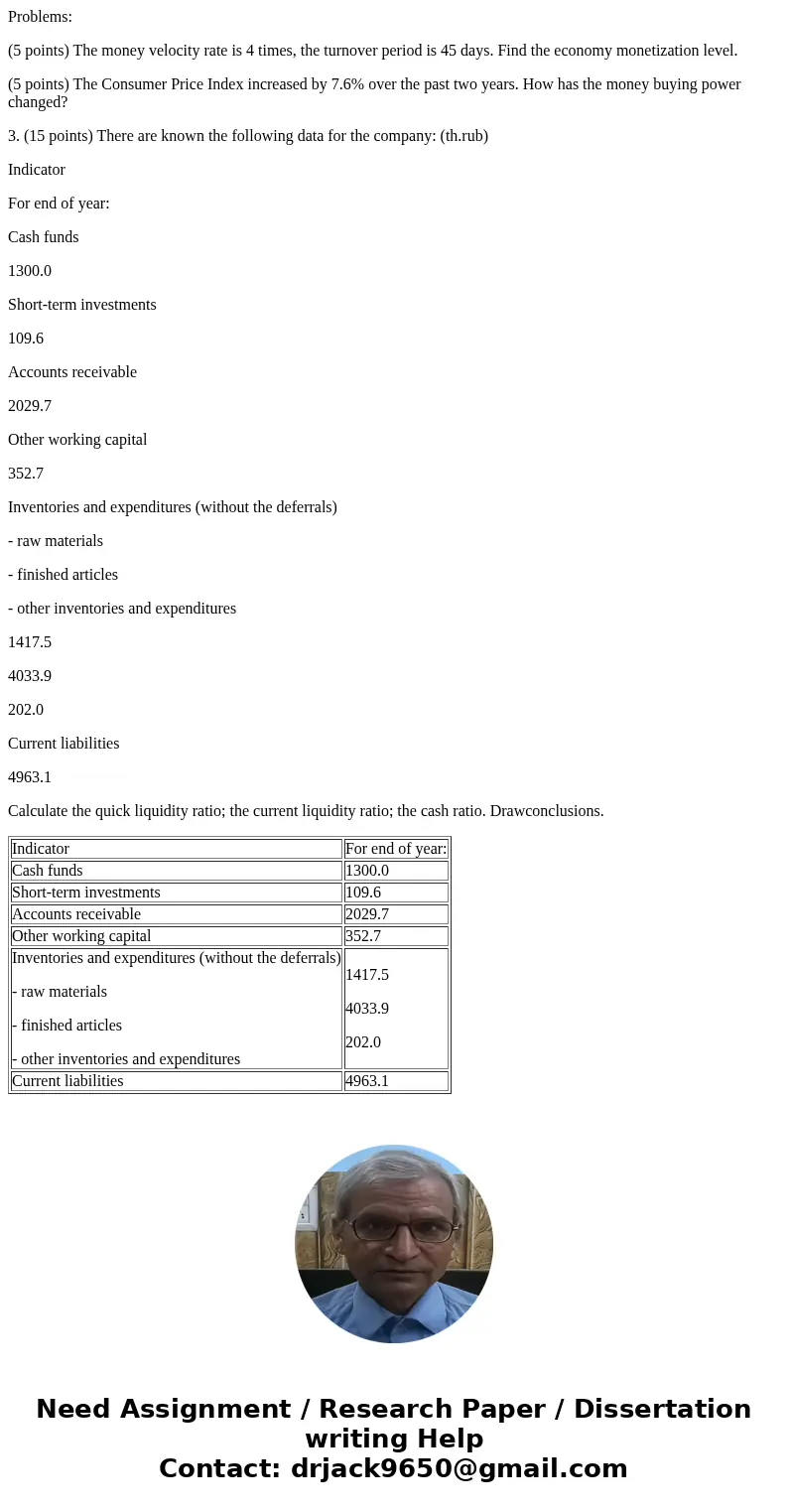

3. (15 points) There are known the following data for the company: (th.rub)

Indicator

For end of year:

Cash funds

1300.0

Short-term investments

109.6

Accounts receivable

2029.7

Other working capital

352.7

Inventories and expenditures (without the deferrals)

- raw materials

- finished articles

- other inventories and expenditures

1417.5

4033.9

202.0

Current liabilities

4963.1

Calculate the quick liquidity ratio; the current liquidity ratio; the cash ratio. Drawconclusions.

| Indicator | For end of year: |

| Cash funds | 1300.0 |

| Short-term investments | 109.6 |

| Accounts receivable | 2029.7 |

| Other working capital | 352.7 |

| Inventories and expenditures (without the deferrals) - raw materials - finished articles - other inventories and expenditures | 1417.5 4033.9 202.0 |

| Current liabilities | 4963.1 |

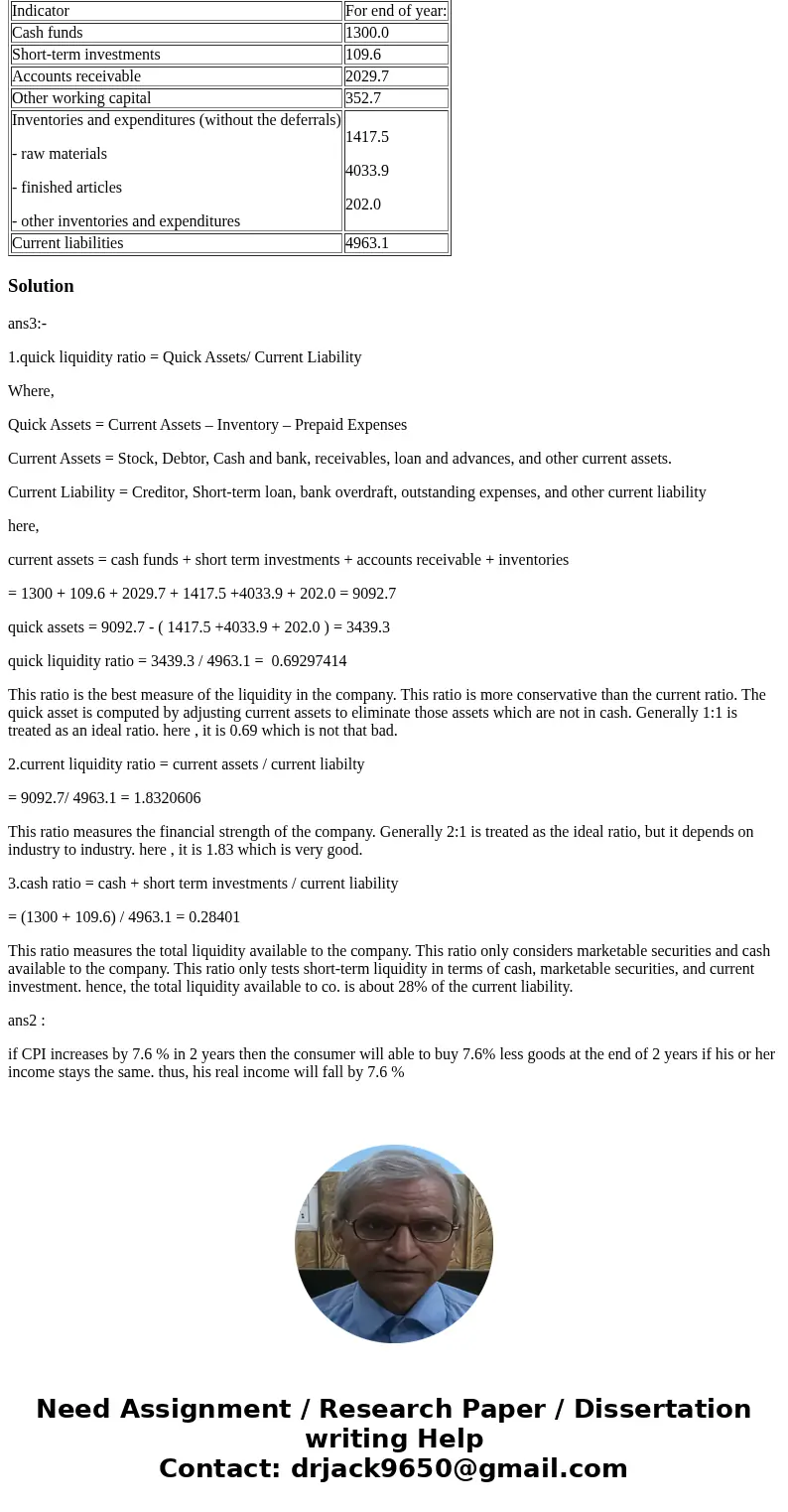

Solution

ans3:-

1.quick liquidity ratio = Quick Assets/ Current Liability

Where,

Quick Assets = Current Assets – Inventory – Prepaid Expenses

Current Assets = Stock, Debtor, Cash and bank, receivables, loan and advances, and other current assets.

Current Liability = Creditor, Short-term loan, bank overdraft, outstanding expenses, and other current liability

here,

current assets = cash funds + short term investments + accounts receivable + inventories

= 1300 + 109.6 + 2029.7 + 1417.5 +4033.9 + 202.0 = 9092.7

quick assets = 9092.7 - ( 1417.5 +4033.9 + 202.0 ) = 3439.3

quick liquidity ratio = 3439.3 / 4963.1 = 0.69297414

This ratio is the best measure of the liquidity in the company. This ratio is more conservative than the current ratio. The quick asset is computed by adjusting current assets to eliminate those assets which are not in cash. Generally 1:1 is treated as an ideal ratio. here , it is 0.69 which is not that bad.

2.current liquidity ratio = current assets / current liabilty

= 9092.7/ 4963.1 = 1.8320606

This ratio measures the financial strength of the company. Generally 2:1 is treated as the ideal ratio, but it depends on industry to industry. here , it is 1.83 which is very good.

3.cash ratio = cash + short term investments / current liability

= (1300 + 109.6) / 4963.1 = 0.28401

This ratio measures the total liquidity available to the company. This ratio only considers marketable securities and cash available to the company. This ratio only tests short-term liquidity in terms of cash, marketable securities, and current investment. hence, the total liquidity available to co. is about 28% of the current liability.

ans2 :

if CPI increases by 7.6 % in 2 years then the consumer will able to buy 7.6% less goods at the end of 2 years if his or her income stays the same. thus, his real income will fall by 7.6 %

Homework Sourse

Homework Sourse