Harris Company borrowed 60000 on a twoyear 8 note dated Octo

Harris Company borrowed $60,000 on a two-year, 8% note dated October 1, 2016.Interest is payable annually on October 1, 2017, and October 1, 2018, the maturity date of the note.The company prepares its financial statements on a calendar year basis.Prepare all journal entries relating to the note for 2016, 2017, and 2018.

On January 1, 2017, Roma Company leased a tractor. The lease agreement qualifies as a capital lease and calls for payments of $10,000 per year (payable each year on January 1, starting in 2018) for eight years. The annual interest rate on the lease is 10%. Roma Company uses a calendar-year reporting period.

Prepare the journal entry for January 1, 2017, to record the leasing of the tractor:

Prepare the journal entry for December 31, 2017, to recognize the interest expense for the year 2017.

Prepare the journal entry to record the first lease payment.

Prepare the journal entry for December 31, 2018, to recognize the interest expense for the year 2018.

Prepare the journal entry to record the January 1, 2019 lease payment.

Solution

Solution:

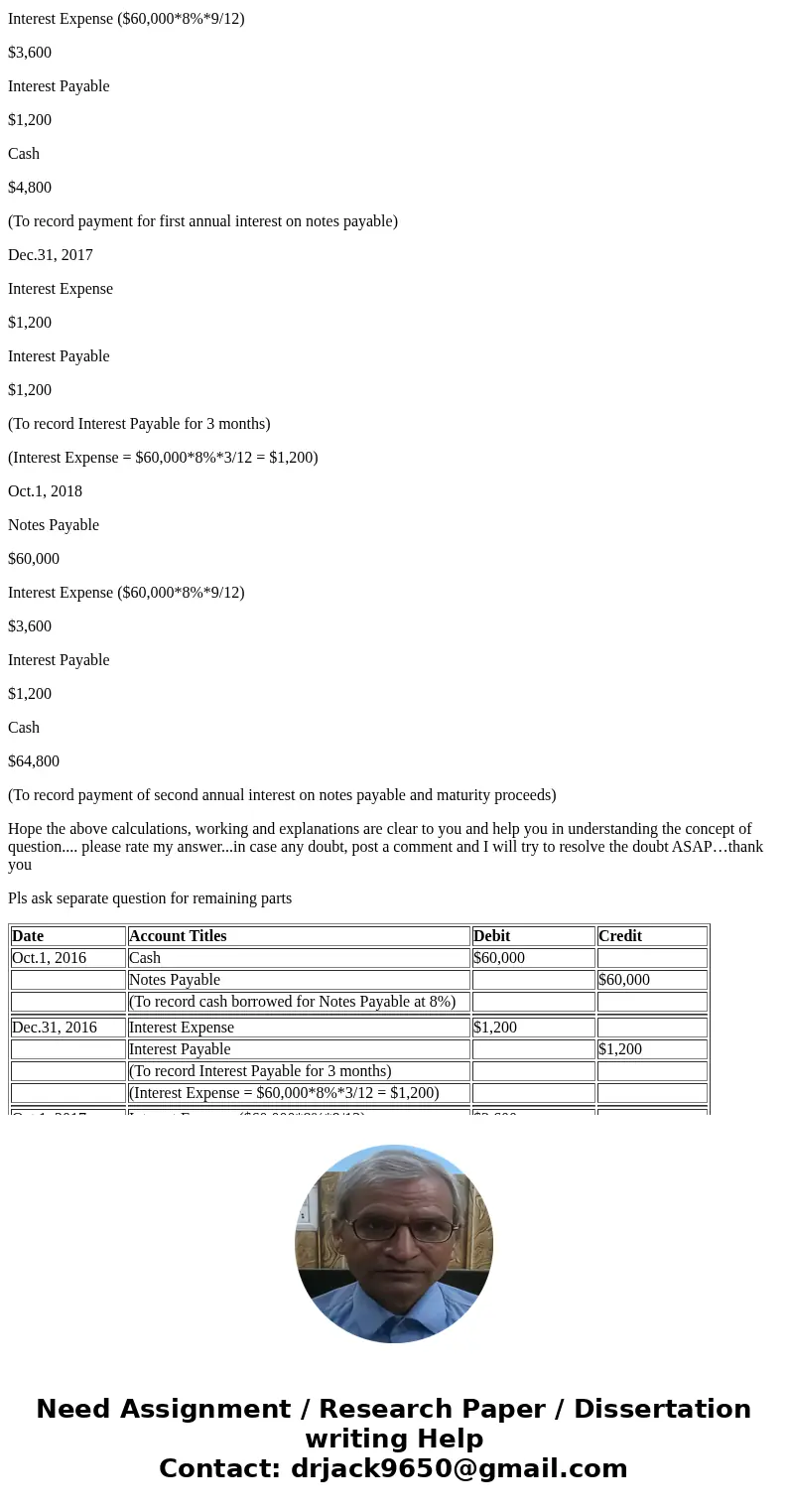

1) Journal Entries for Harris Company

Date

Account Titles

Debit

Credit

Oct.1, 2016

Cash

$60,000

Notes Payable

$60,000

(To record cash borrowed for Notes Payable at 8%)

Dec.31, 2016

Interest Expense

$1,200

Interest Payable

$1,200

(To record Interest Payable for 3 months)

(Interest Expense = $60,000*8%*3/12 = $1,200)

Oct.1, 2017

Interest Expense ($60,000*8%*9/12)

$3,600

Interest Payable

$1,200

Cash

$4,800

(To record payment for first annual interest on notes payable)

Dec.31, 2017

Interest Expense

$1,200

Interest Payable

$1,200

(To record Interest Payable for 3 months)

(Interest Expense = $60,000*8%*3/12 = $1,200)

Oct.1, 2018

Notes Payable

$60,000

Interest Expense ($60,000*8%*9/12)

$3,600

Interest Payable

$1,200

Cash

$64,800

(To record payment of second annual interest on notes payable and maturity proceeds)

Hope the above calculations, working and explanations are clear to you and help you in understanding the concept of question.... please rate my answer...in case any doubt, post a comment and I will try to resolve the doubt ASAP…thank you

Pls ask separate question for remaining parts

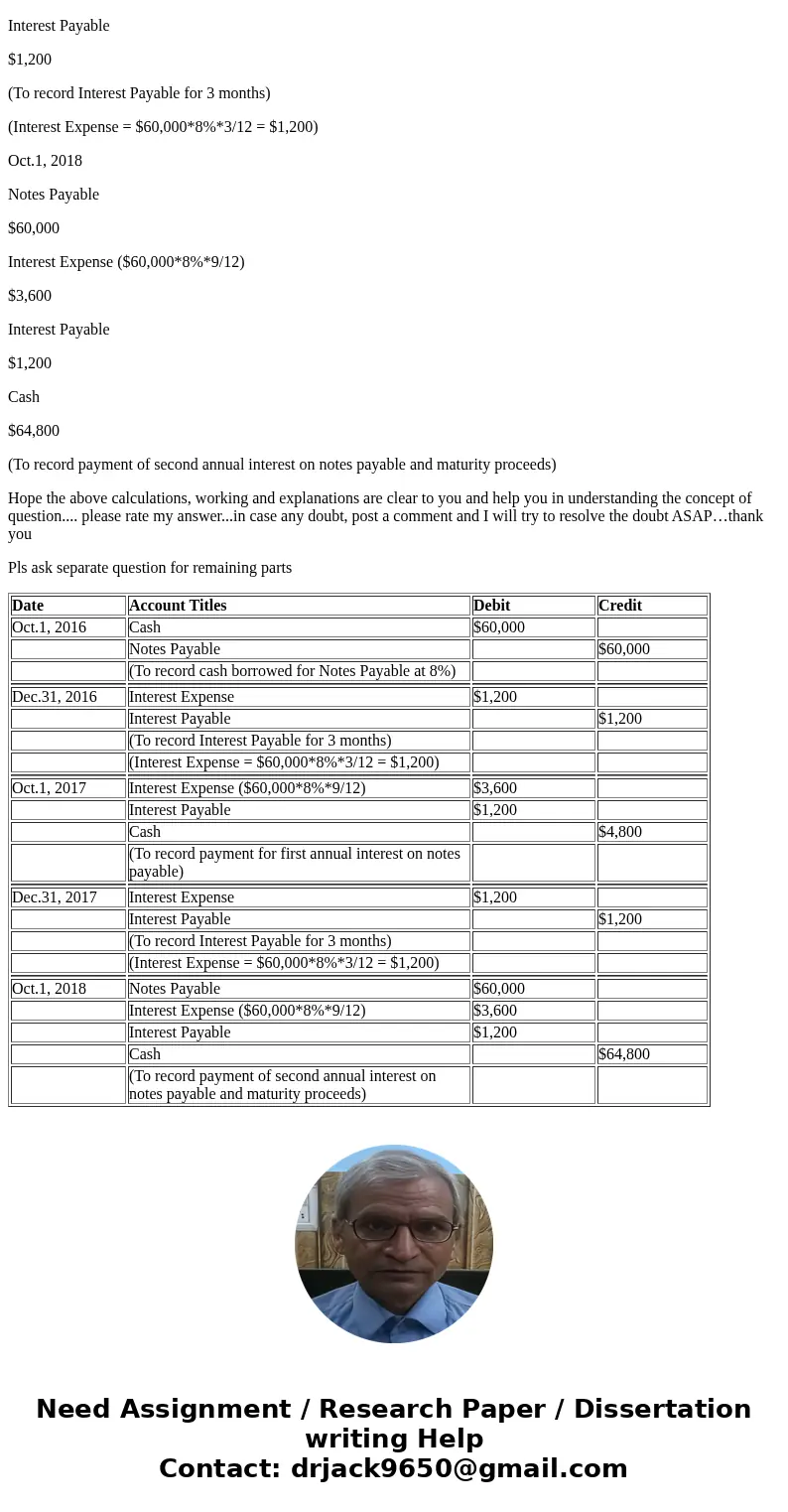

| Date | Account Titles | Debit | Credit |

| Oct.1, 2016 | Cash | $60,000 | |

| Notes Payable | $60,000 | ||

| (To record cash borrowed for Notes Payable at 8%) | |||

| Dec.31, 2016 | Interest Expense | $1,200 | |

| Interest Payable | $1,200 | ||

| (To record Interest Payable for 3 months) | |||

| (Interest Expense = $60,000*8%*3/12 = $1,200) | |||

| Oct.1, 2017 | Interest Expense ($60,000*8%*9/12) | $3,600 | |

| Interest Payable | $1,200 | ||

| Cash | $4,800 | ||

| (To record payment for first annual interest on notes payable) | |||

| Dec.31, 2017 | Interest Expense | $1,200 | |

| Interest Payable | $1,200 | ||

| (To record Interest Payable for 3 months) | |||

| (Interest Expense = $60,000*8%*3/12 = $1,200) | |||

| Oct.1, 2018 | Notes Payable | $60,000 | |

| Interest Expense ($60,000*8%*9/12) | $3,600 | ||

| Interest Payable | $1,200 | ||

| Cash | $64,800 | ||

| (To record payment of second annual interest on notes payable and maturity proceeds) |

Homework Sourse

Homework Sourse