The following information applies to the questions displayed

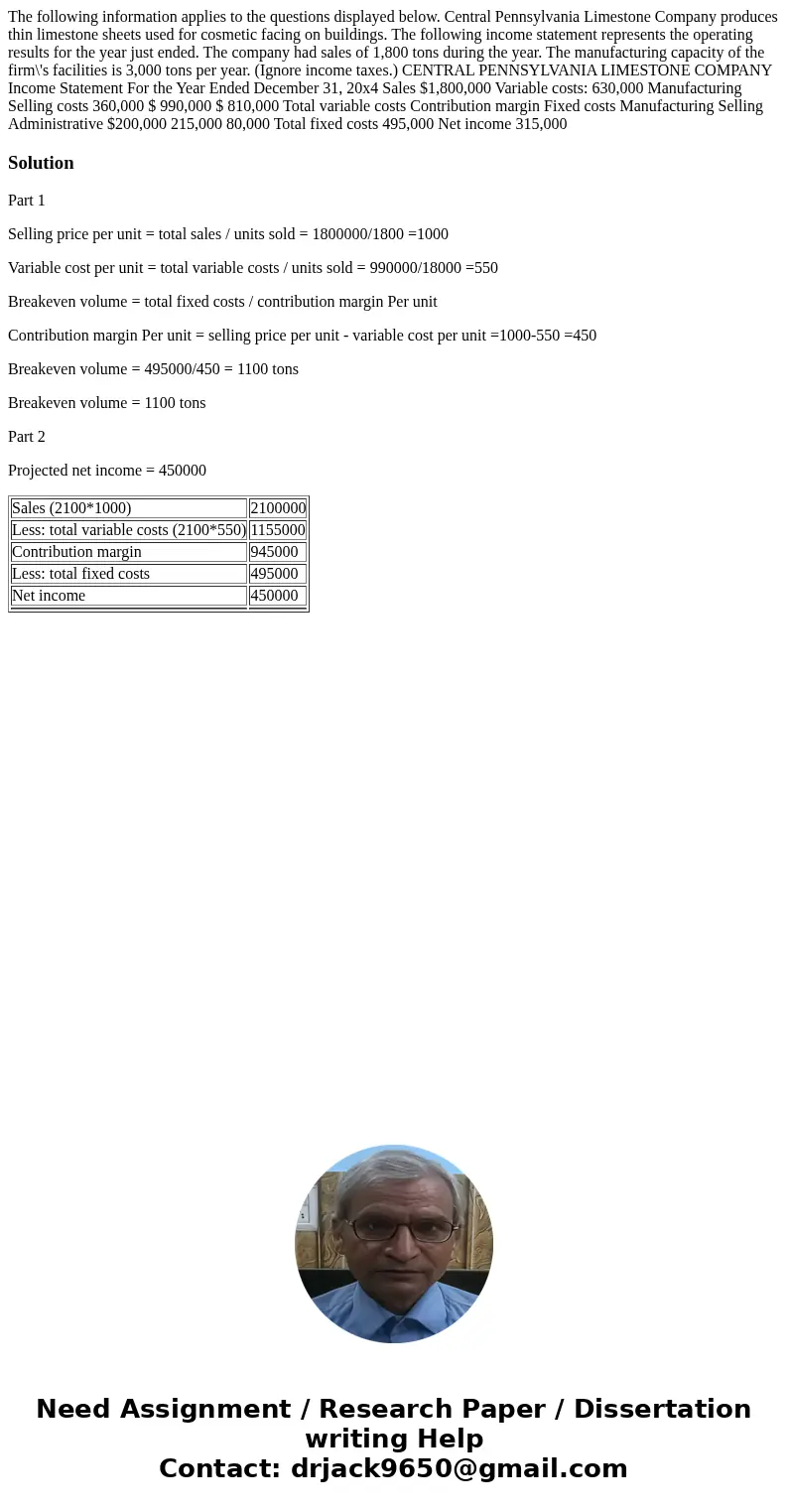

The following information applies to the questions displayed below. Central Pennsylvania Limestone Company produces thin limestone sheets used for cosmetic facing on buildings. The following income statement represents the operating results for the year just ended. The company had sales of 1,800 tons during the year. The manufacturing capacity of the firm\'s facilities is 3,000 tons per year. (Ignore income taxes.) CENTRAL PENNSYLVANIA LIMESTONE COMPANY Income Statement For the Year Ended December 31, 20x4 Sales $1,800,000 Variable costs: 630,000 Manufacturing Selling costs 360,000 $ 990,000 $ 810,000 Total variable costs Contribution margin Fixed costs Manufacturing Selling Administrative $200,000 215,000 80,000 Total fixed costs 495,000 Net income 315,000

Solution

Part 1

Selling price per unit = total sales / units sold = 1800000/1800 =1000

Variable cost per unit = total variable costs / units sold = 990000/18000 =550

Breakeven volume = total fixed costs / contribution margin Per unit

Contribution margin Per unit = selling price per unit - variable cost per unit =1000-550 =450

Breakeven volume = 495000/450 = 1100 tons

Breakeven volume = 1100 tons

Part 2

Projected net income = 450000

| Sales (2100*1000) | 2100000 |

| Less: total variable costs (2100*550) | 1155000 |

| Contribution margin | 945000 |

| Less: total fixed costs | 495000 |

| Net income | 450000 |

Homework Sourse

Homework Sourse