Woodwick Company issues 9 fiveyear bonds on December 31 2016

Solution

Date

General Journal

Debit

Credit

December 31,2016

Cash A/c

112,191

To Premium on Bonds Payable

8,191

To Bond Payable

104,000

[To record the issue of bond]

June 30, 2017

Bond Interest Expenses A/c

3,861

Premium on Bonds Payable A/c

819

To Cash A/c

4,680

[To record the first interest payment on June 30,2017]

December 31,2017

Bond Interest Expenses A/c

3,861

Premium on Bonds Payable A/c

819

To Cash A/c

4,680

[To record the second interest payment on December 31,2017]

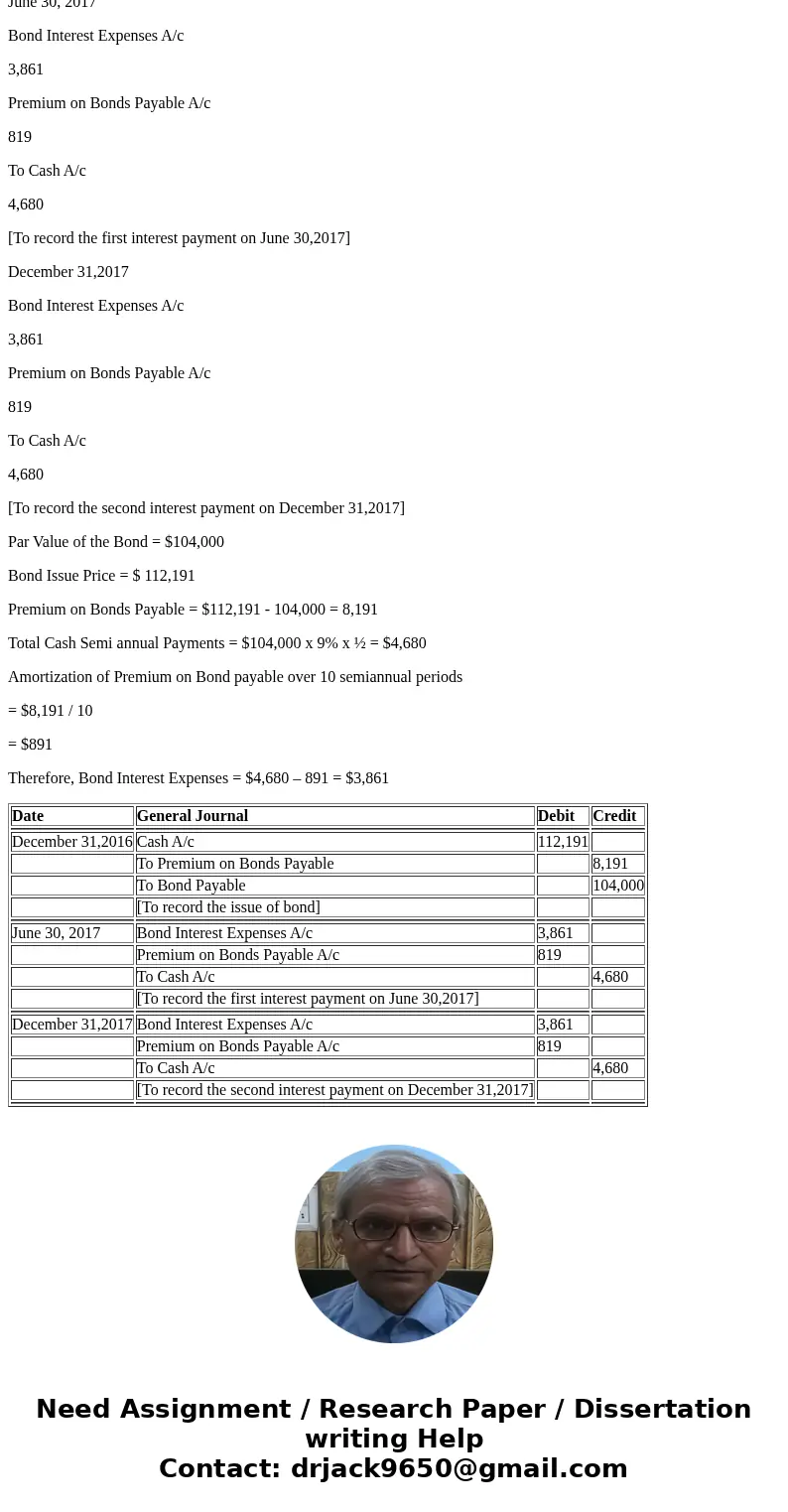

Par Value of the Bond = $104,000

Bond Issue Price = $ 112,191

Premium on Bonds Payable = $112,191 - 104,000 = 8,191

Total Cash Semi annual Payments = $104,000 x 9% x ½ = $4,680

Amortization of Premium on Bond payable over 10 semiannual periods

= $8,191 / 10

= $891

Therefore, Bond Interest Expenses = $4,680 – 891 = $3,861

| Date | General Journal | Debit | Credit |

| December 31,2016 | Cash A/c | 112,191 | |

| To Premium on Bonds Payable | 8,191 | ||

| To Bond Payable | 104,000 | ||

| [To record the issue of bond] | |||

| June 30, 2017 | Bond Interest Expenses A/c | 3,861 | |

| Premium on Bonds Payable A/c | 819 | ||

| To Cash A/c | 4,680 | ||

| [To record the first interest payment on June 30,2017] | |||

| December 31,2017 | Bond Interest Expenses A/c | 3,861 | |

| Premium on Bonds Payable A/c | 819 | ||

| To Cash A/c | 4,680 | ||

| [To record the second interest payment on December 31,2017] | |||

Homework Sourse

Homework Sourse