Please Solve the following problems In 2015 Firm A paid 5000

Please Solve the following problems

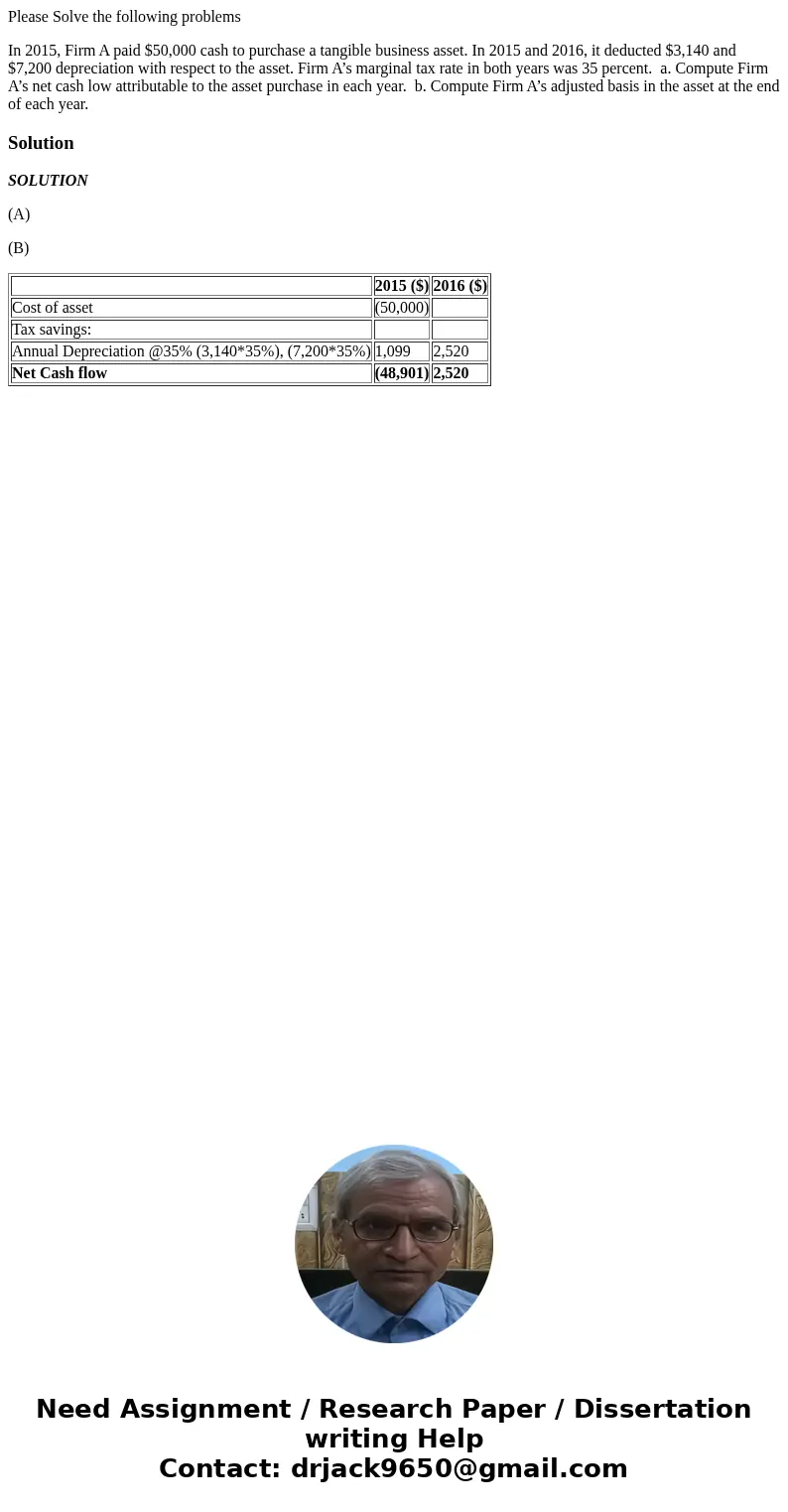

In 2015, Firm A paid $50,000 cash to purchase a tangible business asset. In 2015 and 2016, it deducted $3,140 and $7,200 depreciation with respect to the asset. Firm A’s marginal tax rate in both years was 35 percent. a. Compute Firm A’s net cash low attributable to the asset purchase in each year. b. Compute Firm A’s adjusted basis in the asset at the end of each year.

Solution

SOLUTION

(A)

(B)

| 2015 ($) | 2016 ($) | |

| Cost of asset | (50,000) | |

| Tax savings: | ||

| Annual Depreciation @35% (3,140*35%), (7,200*35%) | 1,099 | 2,520 |

| Net Cash flow | (48,901) | 2,520 |

Homework Sourse

Homework Sourse