TMobile WiFi139 PM LO 133 2 7 Cromwell Corporation does busi

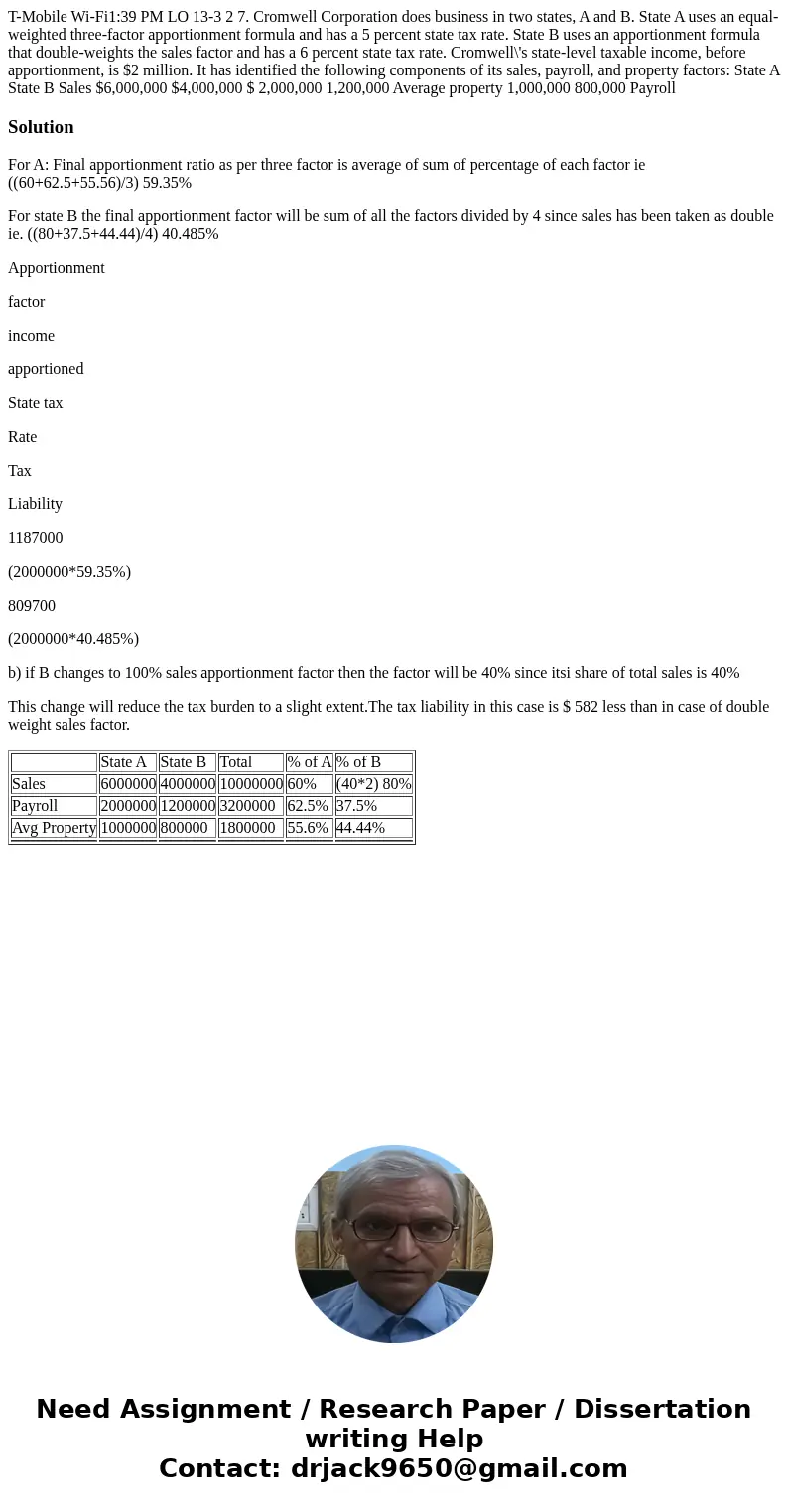

T-Mobile Wi-Fi1:39 PM LO 13-3 2 7. Cromwell Corporation does business in two states, A and B. State A uses an equal-weighted three-factor apportionment formula and has a 5 percent state tax rate. State B uses an apportionment formula that double-weights the sales factor and has a 6 percent state tax rate. Cromwell\'s state-level taxable income, before apportionment, is $2 million. It has identified the following components of its sales, payroll, and property factors: State A State B Sales $6,000,000 $4,000,000 $ 2,000,000 1,200,000 Average property 1,000,000 800,000 Payroll

Solution

For A: Final apportionment ratio as per three factor is average of sum of percentage of each factor ie ((60+62.5+55.56)/3) 59.35%

For state B the final apportionment factor will be sum of all the factors divided by 4 since sales has been taken as double ie. ((80+37.5+44.44)/4) 40.485%

Apportionment

factor

income

apportioned

State tax

Rate

Tax

Liability

1187000

(2000000*59.35%)

809700

(2000000*40.485%)

b) if B changes to 100% sales apportionment factor then the factor will be 40% since itsi share of total sales is 40%

This change will reduce the tax burden to a slight extent.The tax liability in this case is $ 582 less than in case of double weight sales factor.

| State A | State B | Total | % of A | % of B | |

| Sales | 6000000 | 4000000 | 10000000 | 60% | (40*2) 80% |

| Payroll | 2000000 | 1200000 | 3200000 | 62.5% | 37.5% |

| Avg Property | 1000000 | 800000 | 1800000 | 55.6% | 44.44% |

Homework Sourse

Homework Sourse