uestion 1 ee Lin is an Australian resident individual She pu

Solution

(A)/(B)Calculation of Capital Gain

Particulars

in $

Sale Consideration

36,00,00

0

Less:-

Legal cost

4,000

Agents commission

1,08,000

Net Sale Consideration (A)

34,88,00

0

Purchase Consideration

15,50,00

0

Add:-

Stamp duty

70,740

Legal Cost

2,300

Interest on Loan

3,60,000

Council Rates

14,000

Net Purchase Consideration (B)

19,97,04

0

Capital Gain (A-B)- [C]

14,90,96

0

Please note- Since cost inflation index is not given, we have not taken the same for calculation purpose. Also it is assumed that interest cost and council rates are incurred directly foe the purpose of property hence taken.

(C) Calculation of Assessable Income

Particulars

in $

Salary Income

42000

Rental Income

50000

Capital Gain (Refer Note 1)

14,88,83

0

Assessable Income

15,80,83

0

Note 1:-

Calculation of Capital Gain for Income purpose

Long term capital gain

14,90,96

0

Less:- Short term capital loss, set off against long term capital gain

2130

Net Capital gain for Income purpose

14,88,83

0

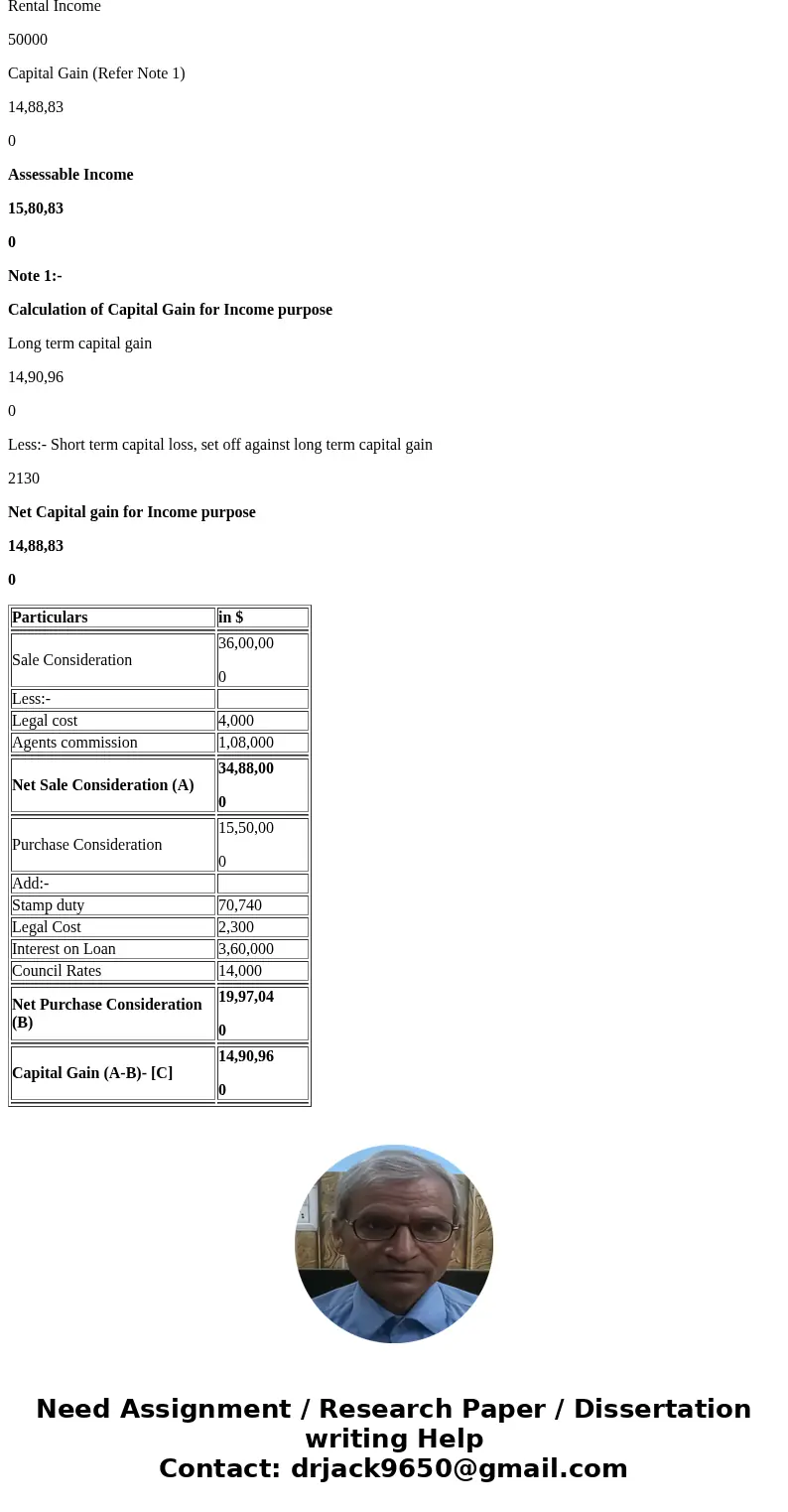

| Particulars | in $ |

| Sale Consideration | 36,00,00 0 |

| Less:- | |

| Legal cost | 4,000 |

| Agents commission | 1,08,000 |

| Net Sale Consideration (A) | 34,88,00 0 |

| Purchase Consideration | 15,50,00 0 |

| Add:- | |

| Stamp duty | 70,740 |

| Legal Cost | 2,300 |

| Interest on Loan | 3,60,000 |

| Council Rates | 14,000 |

| Net Purchase Consideration (B) | 19,97,04 0 |

| Capital Gain (A-B)- [C] | 14,90,96 0 |

Homework Sourse

Homework Sourse