Dowell Company produces a single product Its income statemen

Dowell Company produces a single product. Its income statements under absorption costing for its first two years of operation follow 2016 2017 Sales ($46 per unit) Cost of goods sold ($31 per unit) Gross margin Selling and administrative expenses Net income $1,104,000 $2,024,000 744,000 1,364,000 660,00e 355,000 55,000 305,000 360,000 305,000 Additional Information a. Sales and production data for these first two years follow 2016 34,000 34,000 24,000 44, 000 2017 Units produced Units sold b. Variable cost per unit and total fixed costs are unchanged during 2016 and 2017. The company\'s $31 per unit product cost consists of the following Direct materials Direct labor Variable overhead Fixed overhead ($340,000/34,000 units) Total product cost per unit 10 $31 c. Selling and administrative expenses consist of the following 2016 2017 Variable selling and administrative expenses ($2.5 per unit) Fixed selling and administrative expenses Total selling and administrative expenses $ 60,000 $110,000 245,000 245,000 $305,000 $355,000

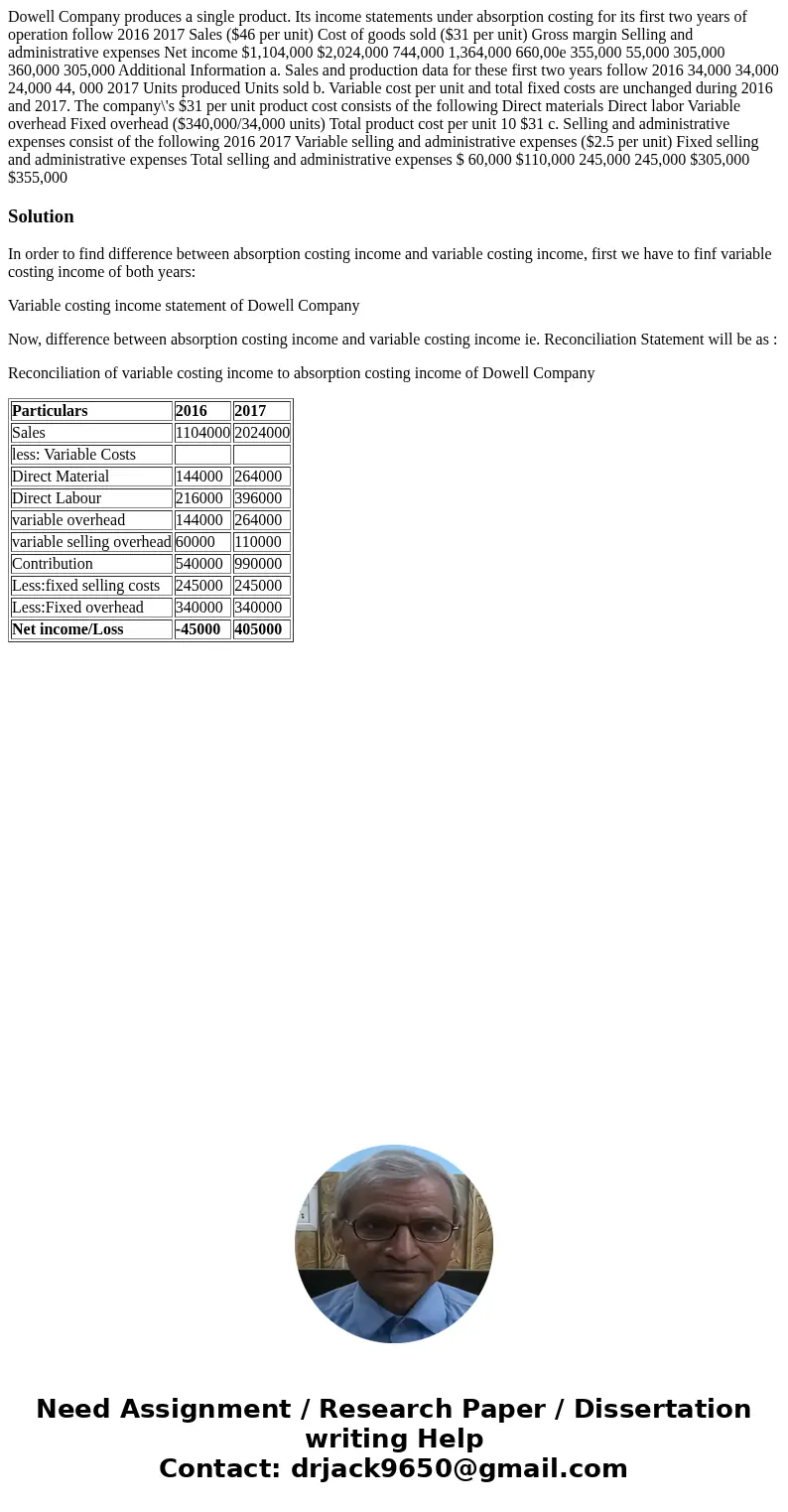

Solution

In order to find difference between absorption costing income and variable costing income, first we have to finf variable costing income of both years:

Variable costing income statement of Dowell Company

Now, difference between absorption costing income and variable costing income ie. Reconciliation Statement will be as :

Reconciliation of variable costing income to absorption costing income of Dowell Company

| Particulars | 2016 | 2017 |

| Sales | 1104000 | 2024000 |

| less: Variable Costs | ||

| Direct Material | 144000 | 264000 |

| Direct Labour | 216000 | 396000 |

| variable overhead | 144000 | 264000 |

| variable selling overhead | 60000 | 110000 |

| Contribution | 540000 | 990000 |

| Less:fixed selling costs | 245000 | 245000 |

| Less:Fixed overhead | 340000 | 340000 |

| Net income/Loss | -45000 | 405000 |

Homework Sourse

Homework Sourse