Following are selected balance sheet accounts of Marin Bros

Solution

Solution:

(a)Payments for purchase of property, plant, and equipment.

Payment made in cash for purchase of property, plant and equipment is $ 55,300.

It will be shown as cash outflow under Investing Activities.

Explanation:

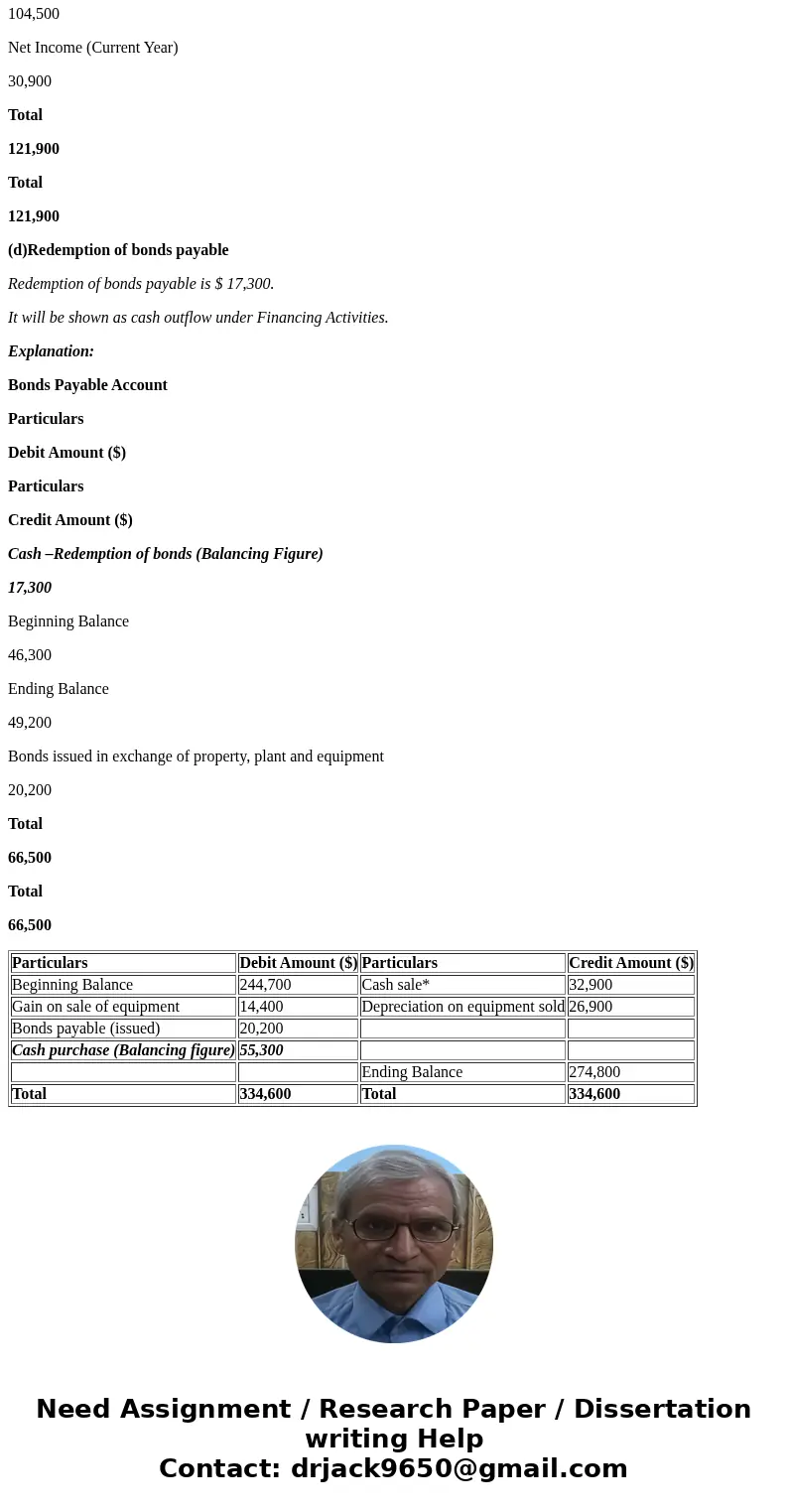

Property, plant, and equipment Account

Particulars

Debit Amount ($)

Particulars

Credit Amount ($)

Beginning Balance

244,700

Cash sale*

32,900

Gain on sale of equipment

14,400

Depreciation on equipment sold

26,900

Bonds payable (issued)

20,200

Cash purchase (Balancing figure)

55,300

Ending Balance

274,800

Total

334,600

Total

334,600

*Cash sale= Cost of equipment- Accumulate depreciation + Gain on sale

= $ 45,400 - $ 26,900 + $ 14,400

= $ 32,900

Accumulated depreciation –plant assets Account

Particulars

Debit Amount ($)

Particulars

Credit Amount ($)

Depreciation on equipment sold (Balancing Figure)

26,900

Beginning Balance

168,200

Ending Balance

179,200

Depreciation (Current Year)

37,900

Total

206,100

Total

206,100

(b) Proceeds from sale of equipment

Cash proceed from sale of equipment

= Cost of equipment- Accumulate depreciation + Gain on sale

= $ 45,400 - $ 26,900 + $ 14,400

= $ 32,900 (Answer)

It will be shown as cash inflow under Investing Activities.

(c)Cash dividends paid

Cash dividend paid is $ 14,400.

It will be shown as cash outflow under Financing Activities.

Retained earnings Account

Particulars

Debit Amount ($)

Particulars

Credit Amount ($)

Dividend paid (Balancing Figure)

14,400

Beginning Balance

91,000

Increase in dividend payable

3,000

Ending Balance

104,500

Net Income (Current Year)

30,900

Total

121,900

Total

121,900

(d)Redemption of bonds payable

Redemption of bonds payable is $ 17,300.

It will be shown as cash outflow under Financing Activities.

Explanation:

Bonds Payable Account

Particulars

Debit Amount ($)

Particulars

Credit Amount ($)

Cash –Redemption of bonds (Balancing Figure)

17,300

Beginning Balance

46,300

Ending Balance

49,200

Bonds issued in exchange of property, plant and equipment

20,200

Total

66,500

Total

66,500

| Particulars | Debit Amount ($) | Particulars | Credit Amount ($) |

| Beginning Balance | 244,700 | Cash sale* | 32,900 |

| Gain on sale of equipment | 14,400 | Depreciation on equipment sold | 26,900 |

| Bonds payable (issued) | 20,200 | ||

| Cash purchase (Balancing figure) | 55,300 | ||

| Ending Balance | 274,800 | ||

| Total | 334,600 | Total | 334,600 |

Homework Sourse

Homework Sourse