Assignment Module 5 Homework ssigment Scone Questions 13 14

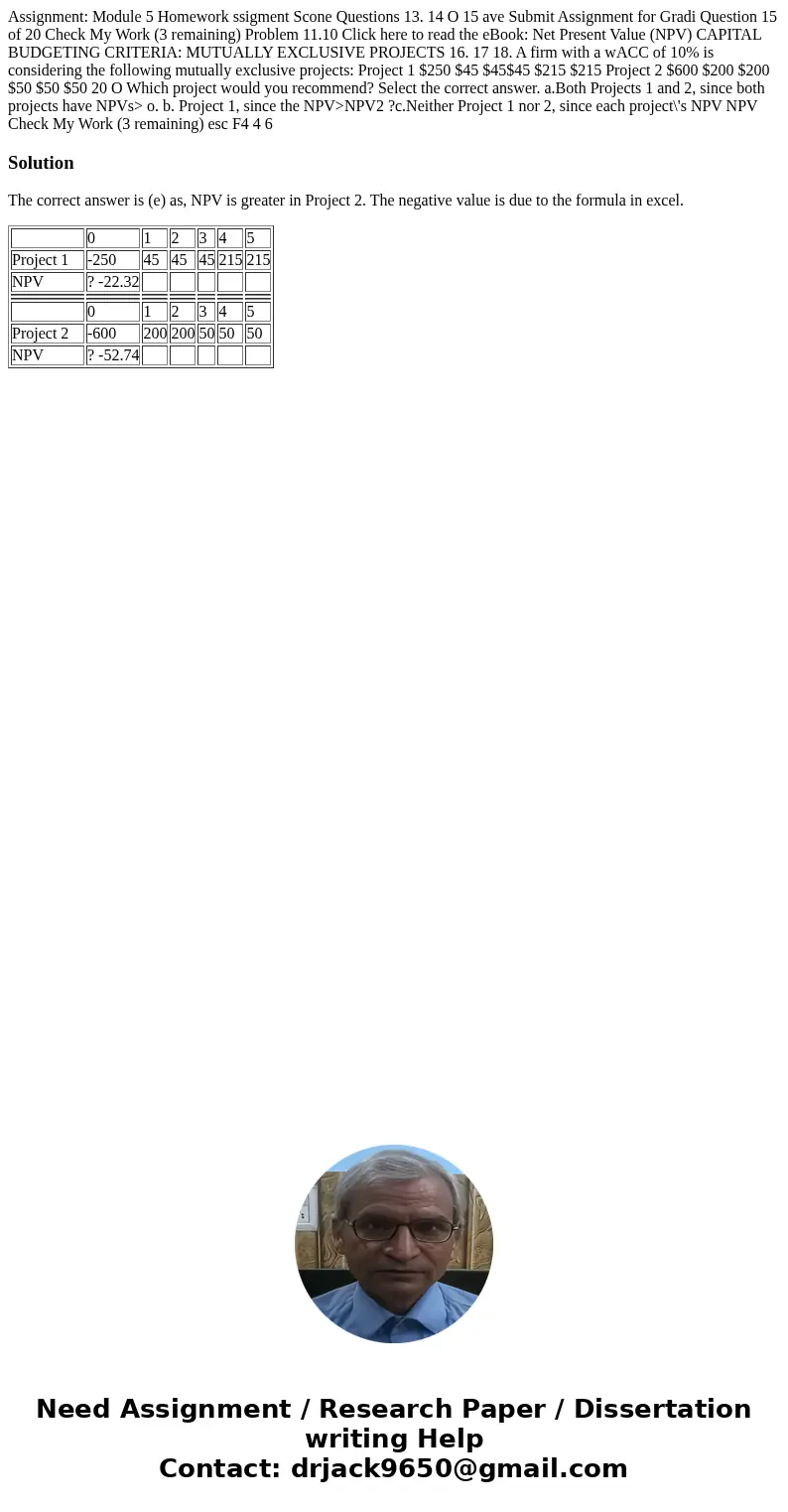

Assignment: Module 5 Homework ssigment Scone Questions 13. 14 O 15 ave Submit Assignment for Gradi Question 15 of 20 Check My Work (3 remaining) Problem 11.10 Click here to read the eBook: Net Present Value (NPV) CAPITAL BUDGETING CRITERIA: MUTUALLY EXCLUSIVE PROJECTS 16. 17 18. A firm with a wACC of 10% is considering the following mutually exclusive projects: Project 1 $250 $45 $45$45 $215 $215 Project 2 $600 $200 $200 $50 $50 $50 20 O Which project would you recommend? Select the correct answer. a.Both Projects 1 and 2, since both projects have NPVs> o. b. Project 1, since the NPV>NPV2 ?c.Neither Project 1 nor 2, since each project\'s NPV NPV Check My Work (3 remaining) esc F4 4 6

Solution

The correct answer is (e) as, NPV is greater in Project 2. The negative value is due to the formula in excel.

| 0 | 1 | 2 | 3 | 4 | 5 | |

| Project 1 | -250 | 45 | 45 | 45 | 215 | 215 |

| NPV | ? -22.32 | |||||

| 0 | 1 | 2 | 3 | 4 | 5 | |

| Project 2 | -600 | 200 | 200 | 50 | 50 | 50 |

| NPV | ? -52.74 |

Homework Sourse

Homework Sourse