bond prices Rlashcards Quilet C Meet inberest Rates And C Ba

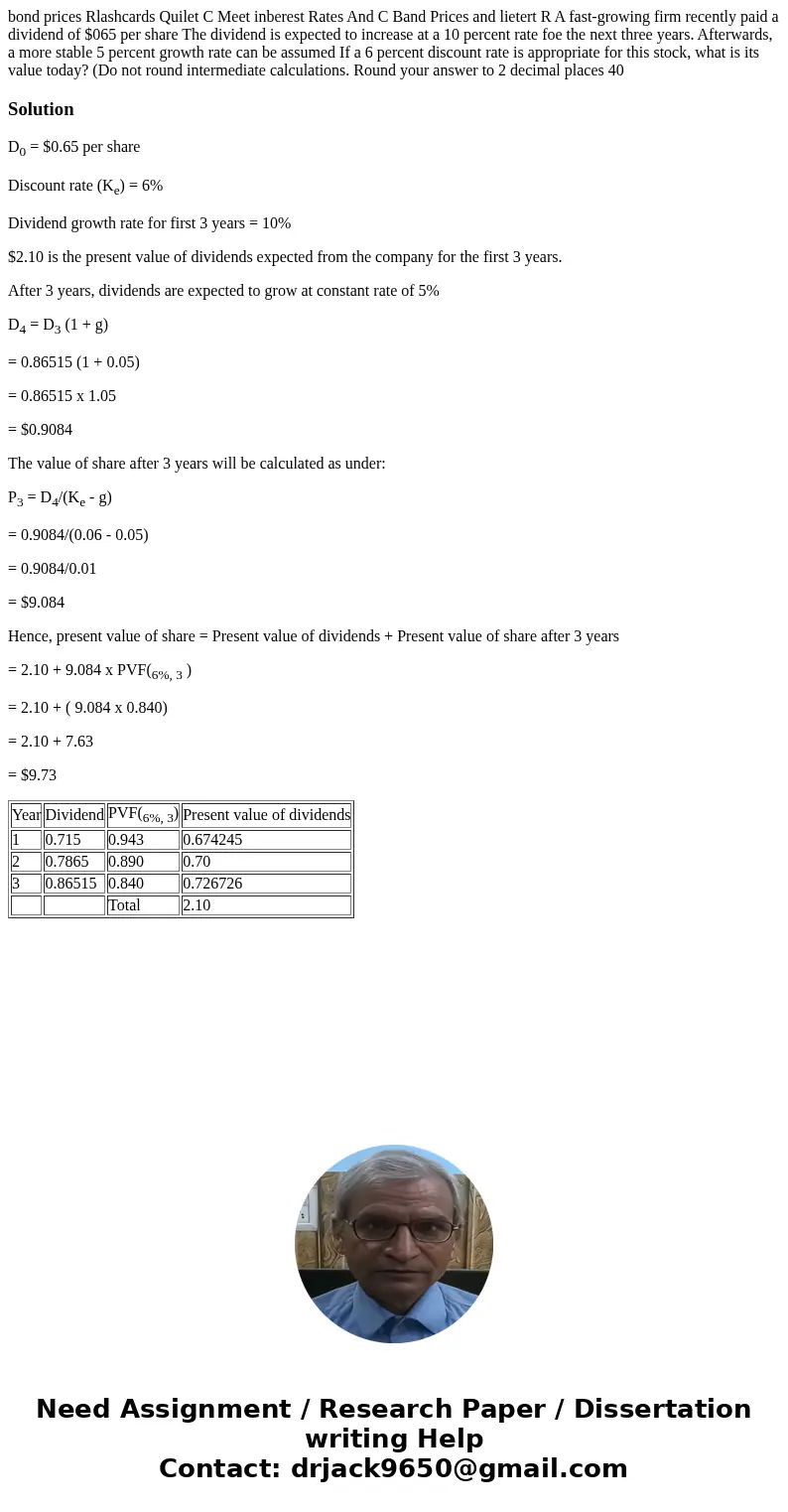

bond prices Rlashcards Quilet C Meet inberest Rates And C Band Prices and lietert R A fast-growing firm recently paid a dividend of $065 per share The dividend is expected to increase at a 10 percent rate foe the next three years. Afterwards, a more stable 5 percent growth rate can be assumed If a 6 percent discount rate is appropriate for this stock, what is its value today? (Do not round intermediate calculations. Round your answer to 2 decimal places 40

Solution

D0 = $0.65 per share

Discount rate (Ke) = 6%

Dividend growth rate for first 3 years = 10%

$2.10 is the present value of dividends expected from the company for the first 3 years.

After 3 years, dividends are expected to grow at constant rate of 5%

D4 = D3 (1 + g)

= 0.86515 (1 + 0.05)

= 0.86515 x 1.05

= $0.9084

The value of share after 3 years will be calculated as under:

P3 = D4/(Ke - g)

= 0.9084/(0.06 - 0.05)

= 0.9084/0.01

= $9.084

Hence, present value of share = Present value of dividends + Present value of share after 3 years

= 2.10 + 9.084 x PVF(6%, 3 )

= 2.10 + ( 9.084 x 0.840)

= 2.10 + 7.63

= $9.73

| Year | Dividend | PVF(6%, 3) | Present value of dividends |

| 1 | 0.715 | 0.943 | 0.674245 |

| 2 | 0.7865 | 0.890 | 0.70 |

| 3 | 0.86515 | 0.840 | 0.726726 |

| Total | 2.10 |

Homework Sourse

Homework Sourse