You are given the cash flow table below Compute and fill in

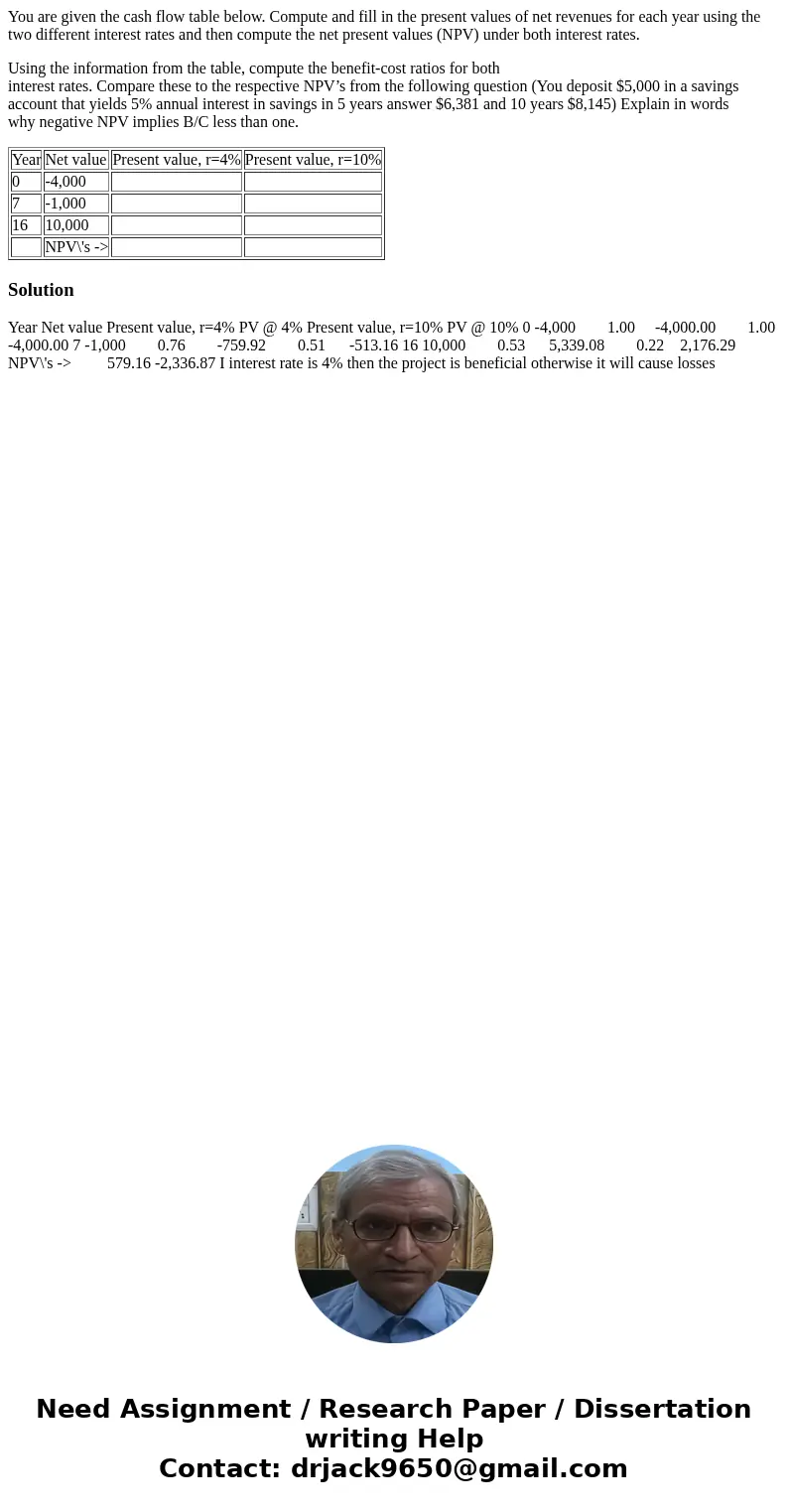

You are given the cash flow table below. Compute and fill in the present values of net revenues for each year using the two different interest rates and then compute the net present values (NPV) under both interest rates.

Using the information from the table, compute the benefit-cost ratios for both

interest rates. Compare these to the respective NPV’s from the following question (You deposit $5,000 in a savings account that yields 5% annual interest in savings in 5 years answer $6,381 and 10 years $8,145) Explain in words

why negative NPV implies B/C less than one.

| Year | Net value | Present value, r=4% | Present value, r=10% |

| 0 | -4,000 | ||

| 7 | -1,000 | ||

| 16 | 10,000 | ||

| NPV\'s -> |

Solution

Year Net value Present value, r=4% PV @ 4% Present value, r=10% PV @ 10% 0 -4,000 1.00 -4,000.00 1.00 -4,000.00 7 -1,000 0.76 -759.92 0.51 -513.16 16 10,000 0.53 5,339.08 0.22 2,176.29 NPV\'s -> 579.16 -2,336.87 I interest rate is 4% then the project is beneficial otherwise it will cause losses

Homework Sourse

Homework Sourse