More Info Car 2014 Jan Jul Dec 2015 1 1 31 Issued 8000000 of

Solution

2014

jan1

cash a/c

discount on issue of debentures

to 6% bonds

( being bonds issued at discount)

7600000

400000

interest a/c

to bonds holders

( being interest becomes due)

* 8000000*6%*6/12=240000

bonds holders a/c

to bank

240000

240000

240000

240000

reserves and surplus a/c

to discount on bonds

* (400000/10)*6/12=20000

interest a/c

to interest outstanding

being interest becomes due.

* reserves and surplus a/c

to discount on bonds

being discount written off

240000

20000

240000

20000

2015

jan 1

interest outstanding a/c

to bank

being interest paid

2024

jan 1

6% bonds a/c

to bank

( being bonds paid at maturity.)

2 carrying amount of bonds payable is $8000000

3.a interest expense for the period ended july 1 2014 is 240000( calculated above)

3.b.cash interest paid is 240000

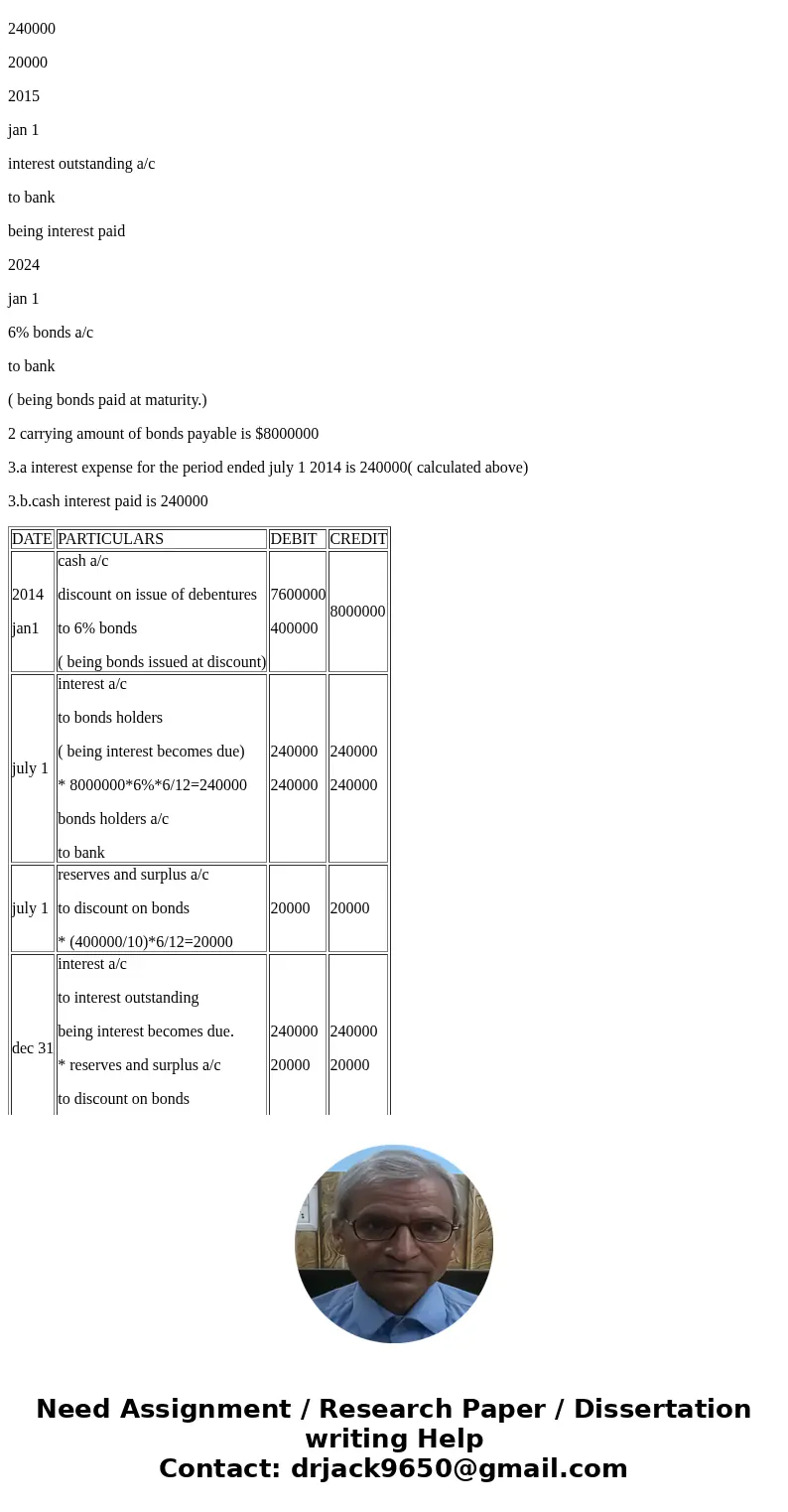

| DATE | PARTICULARS | DEBIT | CREDIT |

| 2014 jan1 | cash a/c discount on issue of debentures to 6% bonds ( being bonds issued at discount) | 7600000 400000 | 8000000 |

| july 1 | interest a/c to bonds holders ( being interest becomes due) * 8000000*6%*6/12=240000 bonds holders a/c to bank | 240000 240000 | 240000 240000 |

| july 1 | reserves and surplus a/c to discount on bonds * (400000/10)*6/12=20000 | 20000 | 20000 |

| dec 31 | interest a/c to interest outstanding being interest becomes due. * reserves and surplus a/c to discount on bonds being discount written off | 240000 20000 | 240000 20000 |

| 2015 jan 1 | interest outstanding a/c to bank being interest paid | 240000 | 240000 |

| 2024 jan 1 | 6% bonds a/c to bank ( being bonds paid at maturity.) | 8000000 | 8000000 |

Homework Sourse

Homework Sourse