Consider the two mutually exclusive projects in the table be

Solution

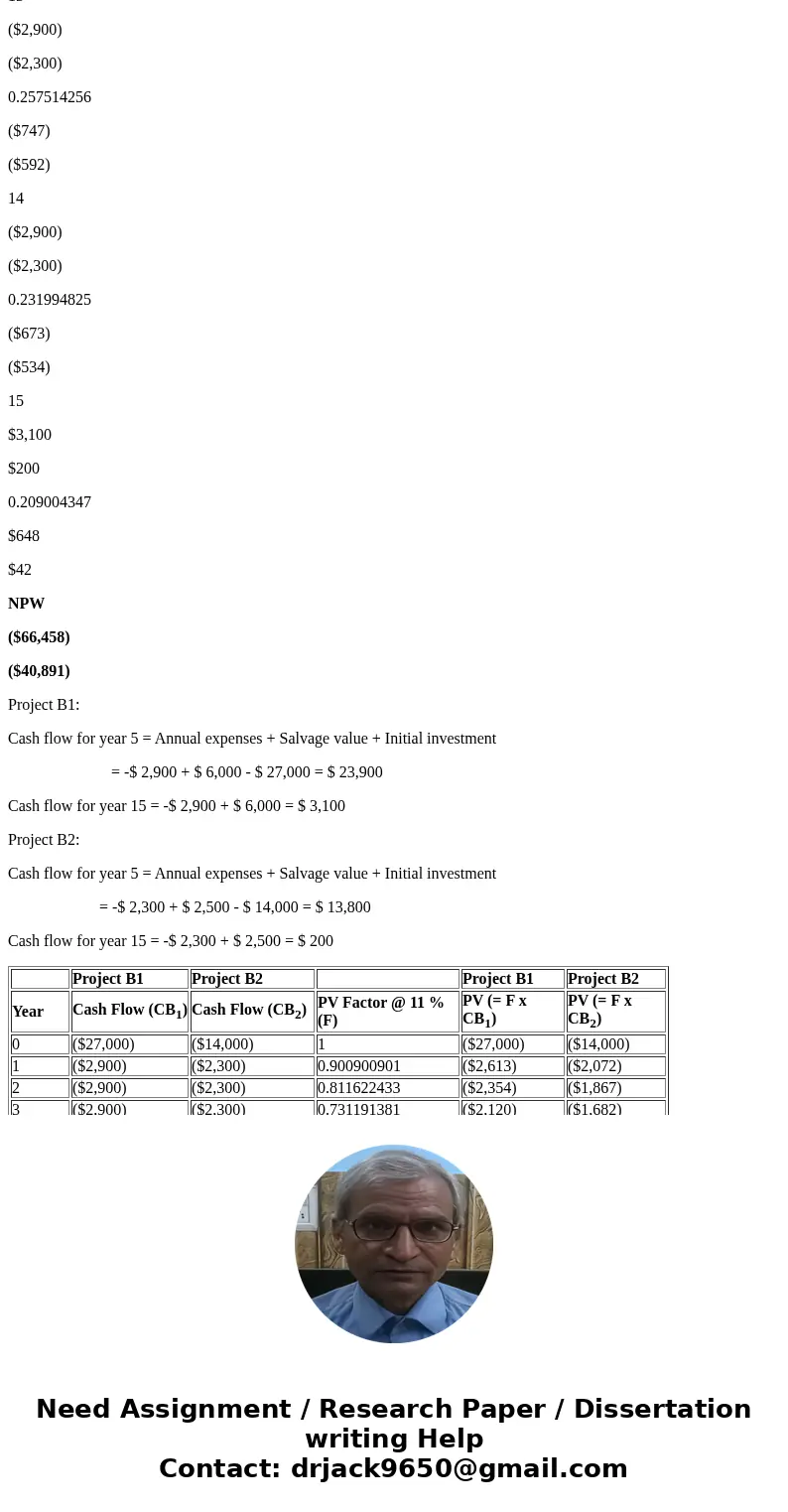

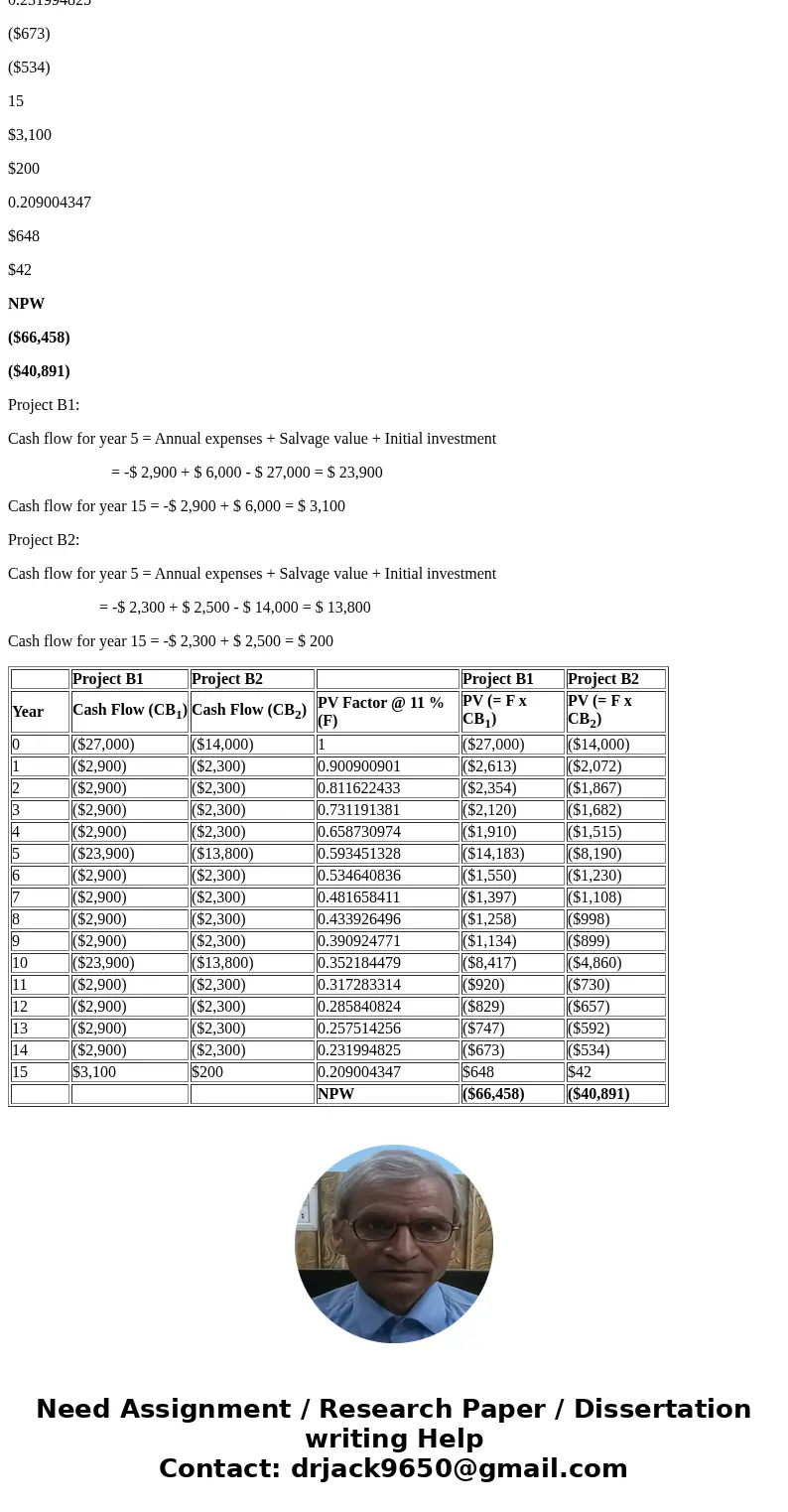

Present worth of Project B1 is ($66,458)

Present worth of Project B2 is ($40,891)

Hence Project B2 is a better choice at MARR of 11 %

Explanation:

Project B1

Project B2

Project B1

Project B2

Year

Cash Flow (CB1)

Cash Flow (CB2)

PV Factor @ 11 % (F)

PV (= F x CB1)

PV (= F x CB2)

0

($27,000)

($14,000)

1

($27,000)

($14,000)

1

($2,900)

($2,300)

0.900900901

($2,613)

($2,072)

2

($2,900)

($2,300)

0.811622433

($2,354)

($1,867)

3

($2,900)

($2,300)

0.731191381

($2,120)

($1,682)

4

($2,900)

($2,300)

0.658730974

($1,910)

($1,515)

5

($23,900)

($13,800)

0.593451328

($14,183)

($8,190)

6

($2,900)

($2,300)

0.534640836

($1,550)

($1,230)

7

($2,900)

($2,300)

0.481658411

($1,397)

($1,108)

8

($2,900)

($2,300)

0.433926496

($1,258)

($998)

9

($2,900)

($2,300)

0.390924771

($1,134)

($899)

10

($23,900)

($13,800)

0.352184479

($8,417)

($4,860)

11

($2,900)

($2,300)

0.317283314

($920)

($730)

12

($2,900)

($2,300)

0.285840824

($829)

($657)

13

($2,900)

($2,300)

0.257514256

($747)

($592)

14

($2,900)

($2,300)

0.231994825

($673)

($534)

15

$3,100

$200

0.209004347

$648

$42

NPW

($66,458)

($40,891)

Project B1:

Cash flow for year 5 = Annual expenses + Salvage value + Initial investment

= -$ 2,900 + $ 6,000 - $ 27,000 = $ 23,900

Cash flow for year 15 = -$ 2,900 + $ 6,000 = $ 3,100

Project B2:

Cash flow for year 5 = Annual expenses + Salvage value + Initial investment

= -$ 2,300 + $ 2,500 - $ 14,000 = $ 13,800

Cash flow for year 15 = -$ 2,300 + $ 2,500 = $ 200

| Project B1 | Project B2 | Project B1 | Project B2 | ||

| Year | Cash Flow (CB1) | Cash Flow (CB2) | PV Factor @ 11 % (F) | PV (= F x CB1) | PV (= F x CB2) |

| 0 | ($27,000) | ($14,000) | 1 | ($27,000) | ($14,000) |

| 1 | ($2,900) | ($2,300) | 0.900900901 | ($2,613) | ($2,072) |

| 2 | ($2,900) | ($2,300) | 0.811622433 | ($2,354) | ($1,867) |

| 3 | ($2,900) | ($2,300) | 0.731191381 | ($2,120) | ($1,682) |

| 4 | ($2,900) | ($2,300) | 0.658730974 | ($1,910) | ($1,515) |

| 5 | ($23,900) | ($13,800) | 0.593451328 | ($14,183) | ($8,190) |

| 6 | ($2,900) | ($2,300) | 0.534640836 | ($1,550) | ($1,230) |

| 7 | ($2,900) | ($2,300) | 0.481658411 | ($1,397) | ($1,108) |

| 8 | ($2,900) | ($2,300) | 0.433926496 | ($1,258) | ($998) |

| 9 | ($2,900) | ($2,300) | 0.390924771 | ($1,134) | ($899) |

| 10 | ($23,900) | ($13,800) | 0.352184479 | ($8,417) | ($4,860) |

| 11 | ($2,900) | ($2,300) | 0.317283314 | ($920) | ($730) |

| 12 | ($2,900) | ($2,300) | 0.285840824 | ($829) | ($657) |

| 13 | ($2,900) | ($2,300) | 0.257514256 | ($747) | ($592) |

| 14 | ($2,900) | ($2,300) | 0.231994825 | ($673) | ($534) |

| 15 | $3,100 | $200 | 0.209004347 | $648 | $42 |

| NPW | ($66,458) | ($40,891) |

Homework Sourse

Homework Sourse