3 Lycan Inc anticipates that it will earn a firm free cash f

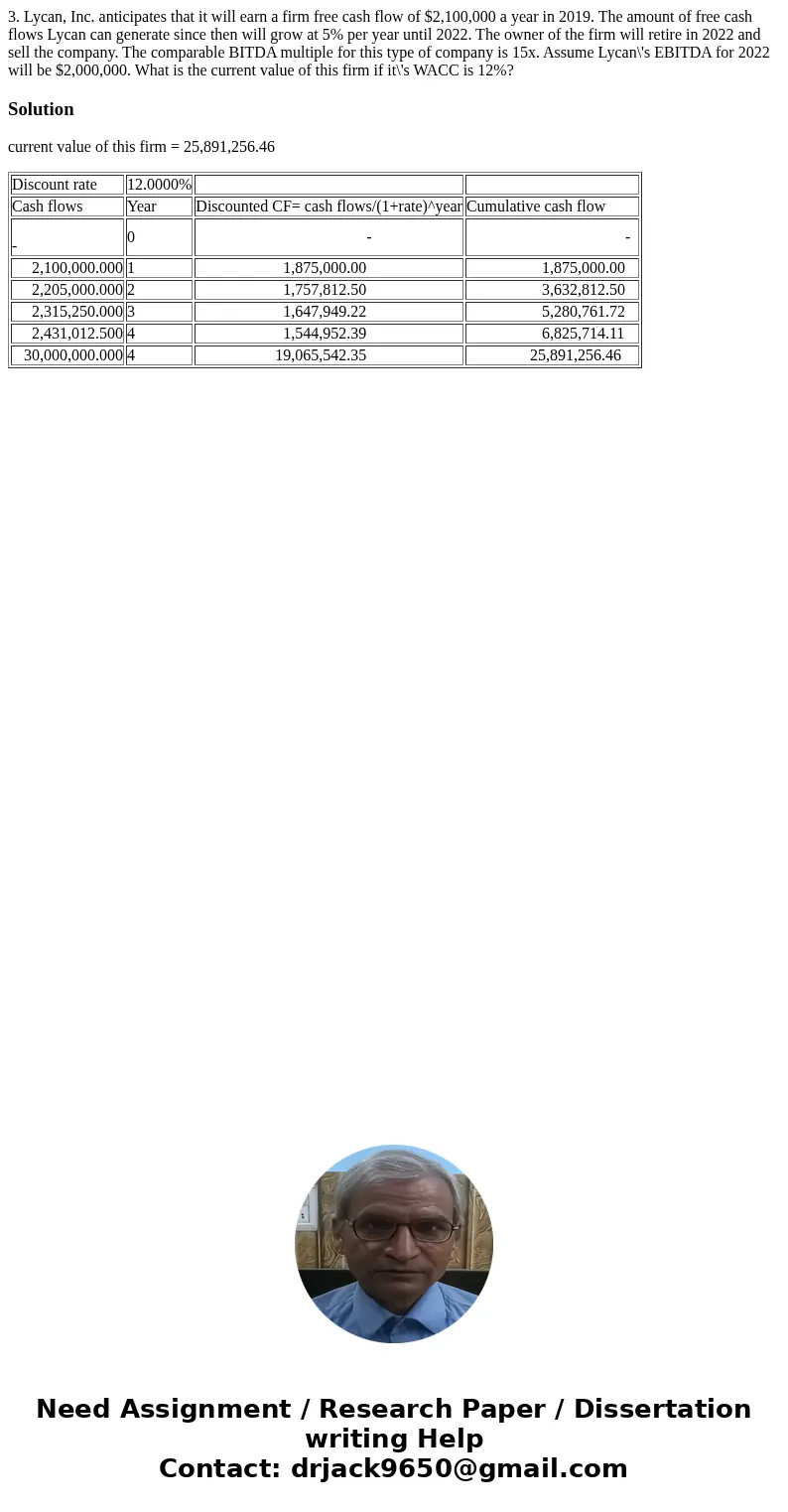

3. Lycan, Inc. anticipates that it will earn a firm free cash flow of $2,100,000 a year in 2019. The amount of free cash flows Lycan can generate since then will grow at 5% per year until 2022. The owner of the firm will retire in 2022 and sell the company. The comparable BITDA multiple for this type of company is 15x. Assume Lycan\'s EBITDA for 2022 will be $2,000,000. What is the current value of this firm if it\'s WACC is 12%?

Solution

current value of this firm = 25,891,256.46

| Discount rate | 12.0000% | ||

| Cash flows | Year | Discounted CF= cash flows/(1+rate)^year | Cumulative cash flow |

| - | 0 | - | - |

| 2,100,000.000 | 1 | 1,875,000.00 | 1,875,000.00 |

| 2,205,000.000 | 2 | 1,757,812.50 | 3,632,812.50 |

| 2,315,250.000 | 3 | 1,647,949.22 | 5,280,761.72 |

| 2,431,012.500 | 4 | 1,544,952.39 | 6,825,714.11 |

| 30,000,000.000 | 4 | 19,065,542.35 | 25,891,256.46 |

Homework Sourse

Homework Sourse