Moms Cookies Inc is considering the purchase of a new cookie

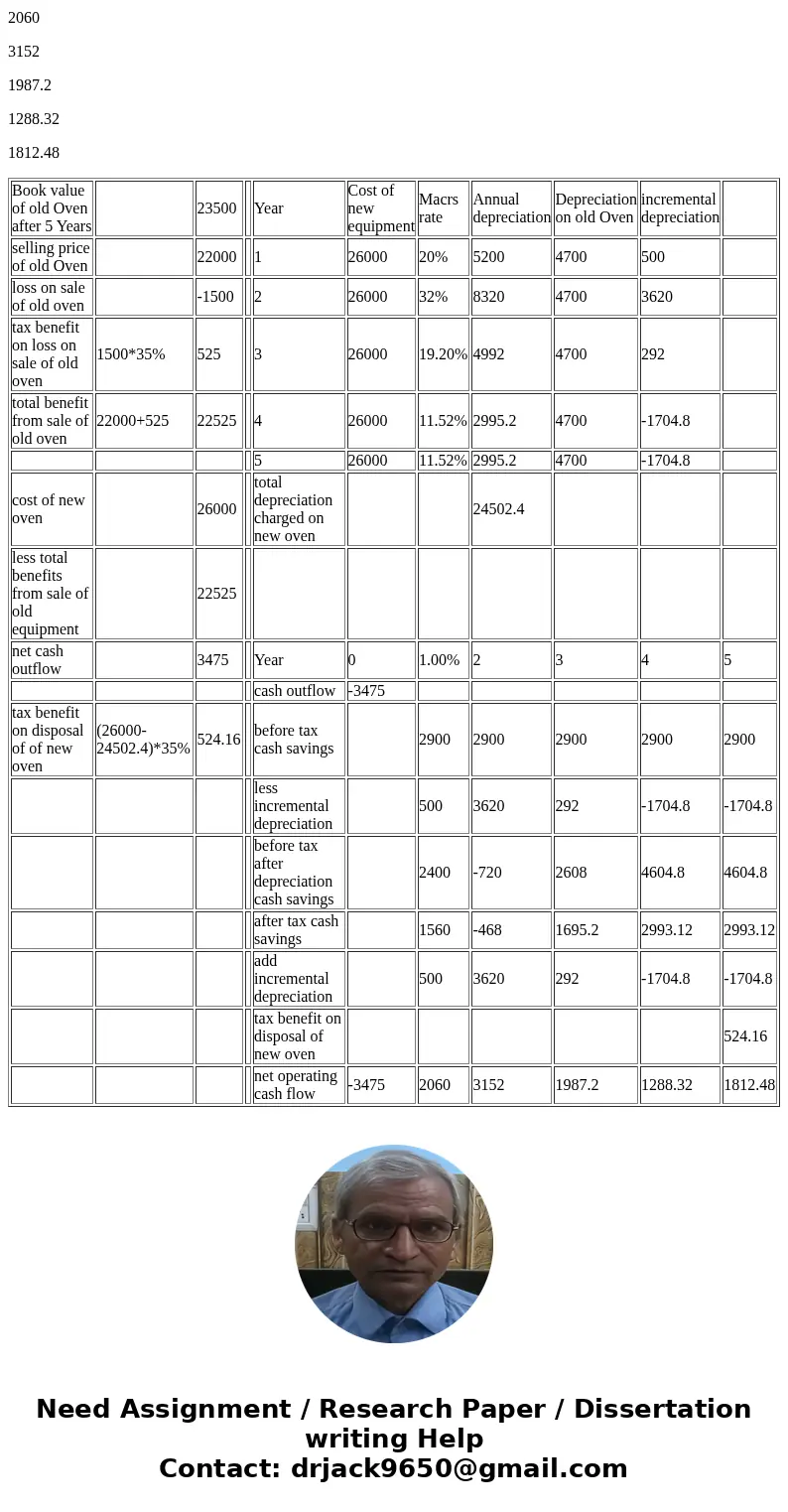

Mom’s Cookies, Inc., is considering the purchase of a new cookie oven. The original cost of the old oven was $47,000; it is now five years old, and it has a current market value of $22,000. The old oven is being depreciated over a 10-year life toward a zero estimated salvage value on a straight-line basis, resulting in a current book value of $23,500 and an annual depreciation expense of $4,700. The old oven can be used for six more years but has no market value after its depreciable life is over. Management is contemplating the purchase of a new oven whose cost is $26,000 and whose estimated salvage value is zero. Expected before-tax cash savings from the new oven are $2,900 a year over its full MACRS depreciable life. Depreciation is computed using MACRS over a 5-year life, and the cost of capital is 10 percent. Assume a 35 percent tax rate. What will the cash flows for this project be? (Note that the $47,000 cost of the old oven is depreciated over ten years at $4,700 per year. The half-year convention is not used for the old oven. Negative amounts should be indicated by a minus sign. Do not round intermediate calculations and round your answers to 2 decimal places.) Year 0 1 2 3 4 5 6 FCF $ $ $ $ $ $ $

Solution

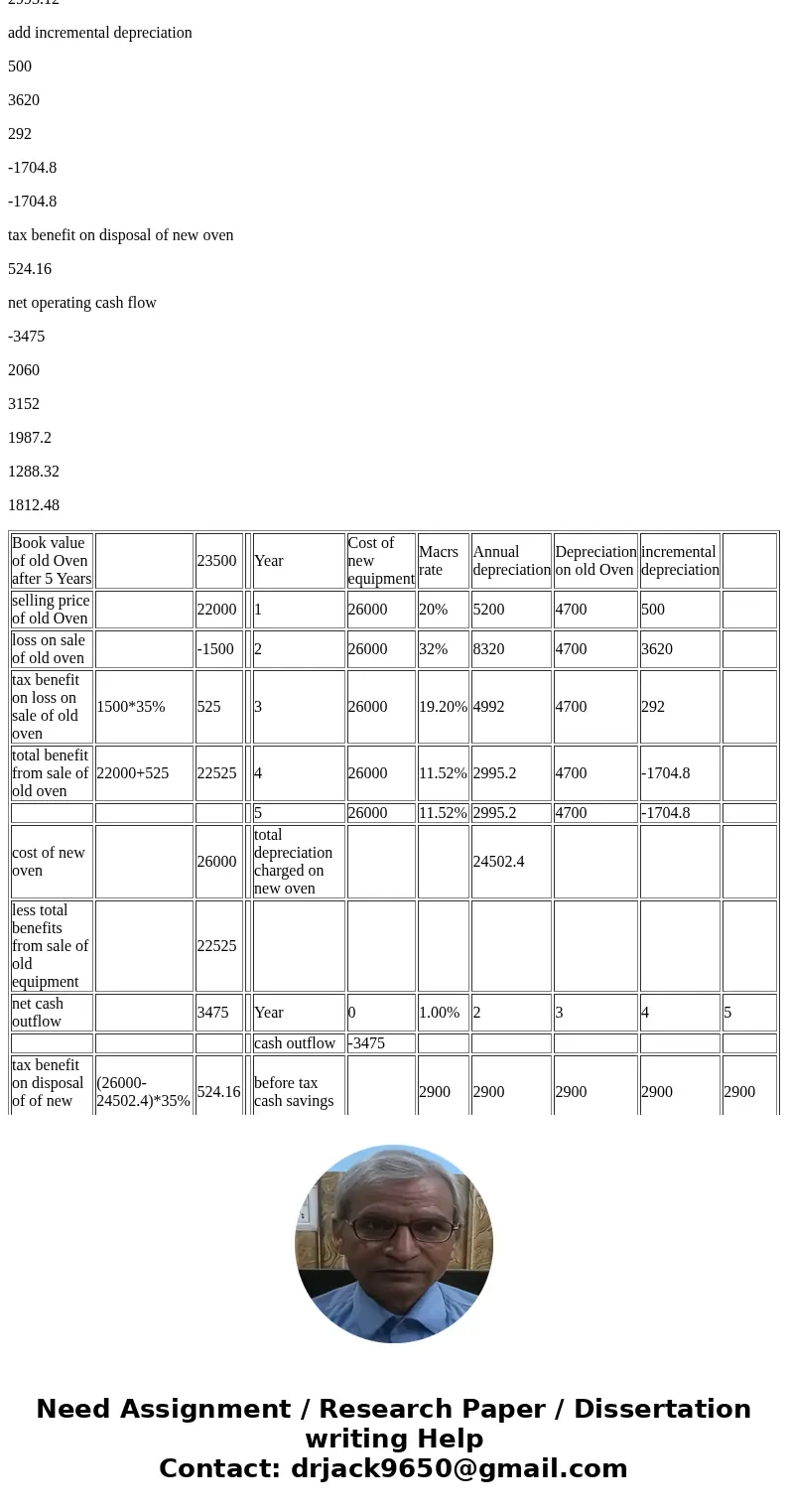

Book value of old Oven after 5 Years

23500

Year

Cost of new equipment

Macrs rate

Annual depreciation

Depreciation on old Oven

incremental depreciation

selling price of old Oven

22000

1

26000

20%

5200

4700

500

loss on sale of old oven

-1500

2

26000

32%

8320

4700

3620

tax benefit on loss on sale of old oven

1500*35%

525

3

26000

19.20%

4992

4700

292

total benefit from sale of old oven

22000+525

22525

4

26000

11.52%

2995.2

4700

-1704.8

5

26000

11.52%

2995.2

4700

-1704.8

cost of new oven

26000

total depreciation charged on new oven

24502.4

less total benefits from sale of old equipment

22525

net cash outflow

3475

Year

0

1.00%

2

3

4

5

cash outflow

-3475

tax benefit on disposal of of new oven

(26000-24502.4)*35%

524.16

before tax cash savings

2900

2900

2900

2900

2900

less incremental depreciation

500

3620

292

-1704.8

-1704.8

before tax after depreciation cash savings

2400

-720

2608

4604.8

4604.8

after tax cash savings

1560

-468

1695.2

2993.12

2993.12

add incremental depreciation

500

3620

292

-1704.8

-1704.8

tax benefit on disposal of new oven

524.16

net operating cash flow

-3475

2060

3152

1987.2

1288.32

1812.48

| Book value of old Oven after 5 Years | 23500 | Year | Cost of new equipment | Macrs rate | Annual depreciation | Depreciation on old Oven | incremental depreciation | |||

| selling price of old Oven | 22000 | 1 | 26000 | 20% | 5200 | 4700 | 500 | |||

| loss on sale of old oven | -1500 | 2 | 26000 | 32% | 8320 | 4700 | 3620 | |||

| tax benefit on loss on sale of old oven | 1500*35% | 525 | 3 | 26000 | 19.20% | 4992 | 4700 | 292 | ||

| total benefit from sale of old oven | 22000+525 | 22525 | 4 | 26000 | 11.52% | 2995.2 | 4700 | -1704.8 | ||

| 5 | 26000 | 11.52% | 2995.2 | 4700 | -1704.8 | |||||

| cost of new oven | 26000 | total depreciation charged on new oven | 24502.4 | |||||||

| less total benefits from sale of old equipment | 22525 | |||||||||

| net cash outflow | 3475 | Year | 0 | 1.00% | 2 | 3 | 4 | 5 | ||

| cash outflow | -3475 | |||||||||

| tax benefit on disposal of of new oven | (26000-24502.4)*35% | 524.16 | before tax cash savings | 2900 | 2900 | 2900 | 2900 | 2900 | ||

| less incremental depreciation | 500 | 3620 | 292 | -1704.8 | -1704.8 | |||||

| before tax after depreciation cash savings | 2400 | -720 | 2608 | 4604.8 | 4604.8 | |||||

| after tax cash savings | 1560 | -468 | 1695.2 | 2993.12 | 2993.12 | |||||

| add incremental depreciation | 500 | 3620 | 292 | -1704.8 | -1704.8 | |||||

| tax benefit on disposal of new oven | 524.16 | |||||||||

| net operating cash flow | -3475 | 2060 | 3152 | 1987.2 | 1288.32 | 1812.48 |

Homework Sourse

Homework Sourse