Transaction 1 October 1 2016 Opened a bank account for Craft

Transaction: 1) October 1, 2016: Opened a bank account for Craft Fair rentals with $100.

2) October 1, 2016: Took out a loan $14,000 from Best Bank and deposited it into the account to pay for expenses. Record as Best Bank Loan payable.

3) October 1, 2016: Bought 20 folding tables from Staples for $1,500 on account. Expect the tables to last 3 years with no disposal value

4) October 1, 2016: Bought 40 chairs from Staples for $1,200 on account. Expect the chairs to last 2 years with no disposal value

5) October 2, 2016: bought 40 table cloths for $800 from Sears on account. Expect to last only 1 season, so expense.

6) October 2, 2016: bought cleaning supplies for $97.00 from Super Store. Paid cash. Will use up within the year.

7) October 5, 2016: Purchased a cash register for $2,500 from ABC Business Machines. It is expected to last 5 years.

8) October 1, 2016: paid $6,000 for 3 months’ rental, (October 1 to December 31, 2017) to OK Hall rentals.

9) October 31, 2016: Best Bank charge, interest on loan $33.33, other bank charges $7.50

10) October 31, 2016: Received $4,800 for the month for table rentals. All paid in cash.

11) October 31, 2016: Paid the Staples account $2,200.

12) October 31, 2016: Mr. Bro drew $3,000 out for his living expenses.

13) November 5, 2016: Paid Sears account $800.00 cash for table cloths. (see #5)

14) November 15, 2016: Paid “The Fix-it Man” $79.00 cash for repairs on the tables.

15) November 30, 2016: Sales invoice 1002 for table rentals of $9,000. $5,000 was paid in cash, balance on account.

16) November 30, 2016: Interest on loan, $33.33 and bank charges $7.50

17) November 30, 2016: Mr. Bro drew $3,000 out for his living expenses.

18) December 14, 2016: Received $4,000 cash for the balance of invoice #1002

19) December 15, 2016: Sales invoice 1003 for table rentals of $7,000. $5,000 in cash, balance on account.

20) December 29, 2016: Sales invoice 1004 for table rentals of $3,000, $1,000 in cash, balance on account.

21) December 30, 2016: Received $2,000 cash for payment of invoice 1003. (see # 20)

22) December 30, 2016: The Fix-it Man charged $58.00 for repairs. Will be paid in January.

23) December 31, 2016: Best Bank interest on loan of $33.33 and bank charges of $7.50.

24) December 31, 2016: Mr. Bro drew $3,000 out for his living expenses.

25) December 31, 2016: Paid $7,000 on the loan owing to Best Bank.

December 31, 2016: Computed amortization expense and accumulated amortization of $500 for the tables, $600 for the chairs and $500 for the cash registrar.

Q1:Prepare the journal entries to record the transactions.

a)Post the journal entries to a T-account

b) Prepare the trial balance

c) Prepare the income statement of the owner\'s equity for three months (Oct-December)

d) Prepare the balance sheet as of Dec. 31

e) Was the fall work successful? Should it continue in the fall 2017? Give reasons

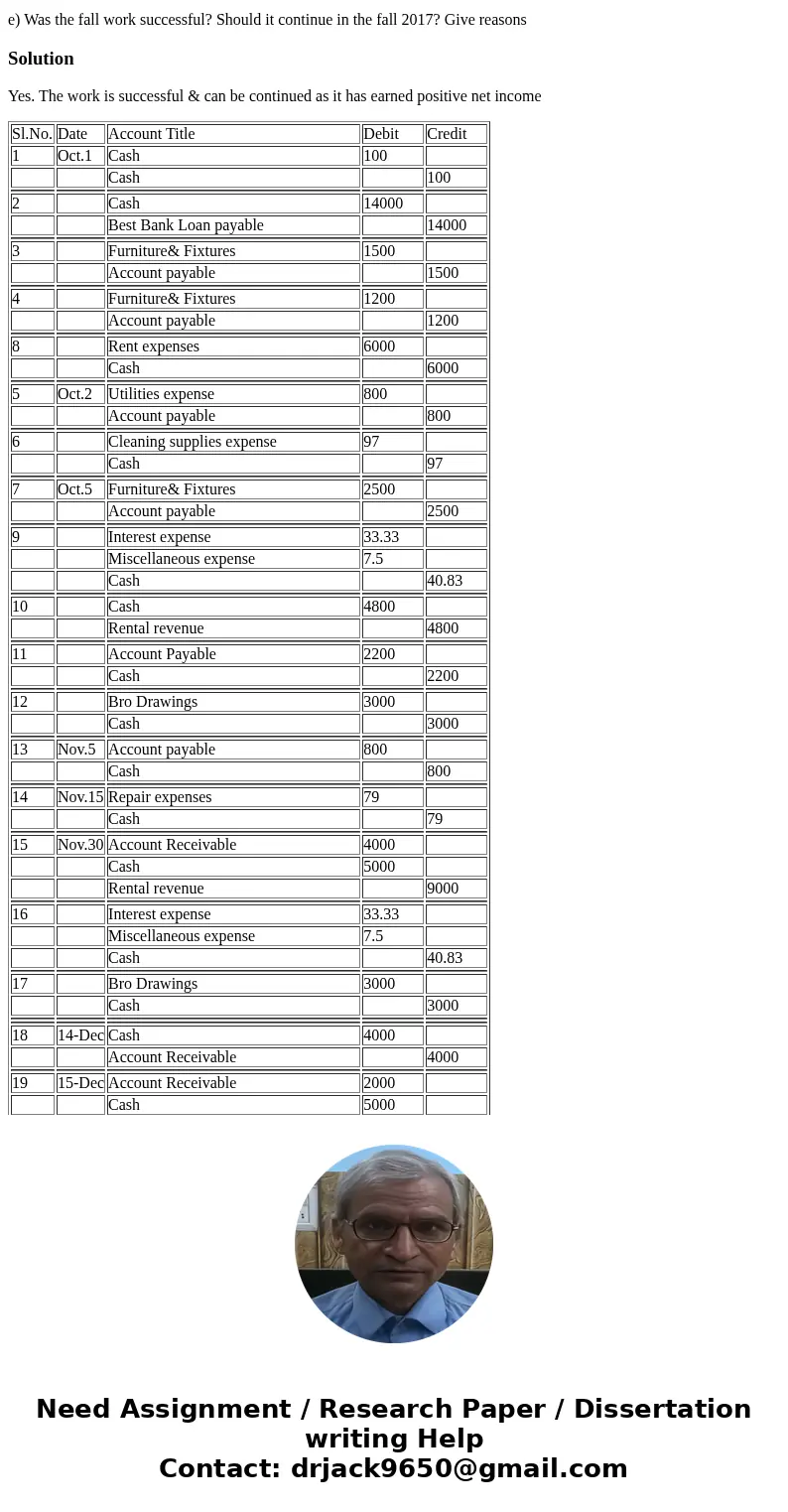

Solution

Yes. The work is successful & can be continued as it has earned positive net income

| Sl.No. | Date | Account Title | Debit | Credit |

| 1 | Oct.1 | Cash | 100 | |

| Cash | 100 | |||

| 2 | Cash | 14000 | ||

| Best Bank Loan payable | 14000 | |||

| 3 | Furniture& Fixtures | 1500 | ||

| Account payable | 1500 | |||

| 4 | Furniture& Fixtures | 1200 | ||

| Account payable | 1200 | |||

| 8 | Rent expenses | 6000 | ||

| Cash | 6000 | |||

| 5 | Oct.2 | Utilities expense | 800 | |

| Account payable | 800 | |||

| 6 | Cleaning supplies expense | 97 | ||

| Cash | 97 | |||

| 7 | Oct.5 | Furniture& Fixtures | 2500 | |

| Account payable | 2500 | |||

| 9 | Interest expense | 33.33 | ||

| Miscellaneous expense | 7.5 | |||

| Cash | 40.83 | |||

| 10 | Cash | 4800 | ||

| Rental revenue | 4800 | |||

| 11 | Account Payable | 2200 | ||

| Cash | 2200 | |||

| 12 | Bro Drawings | 3000 | ||

| Cash | 3000 | |||

| 13 | Nov.5 | Account payable | 800 | |

| Cash | 800 | |||

| 14 | Nov.15 | Repair expenses | 79 | |

| Cash | 79 | |||

| 15 | Nov.30 | Account Receivable | 4000 | |

| Cash | 5000 | |||

| Rental revenue | 9000 | |||

| 16 | Interest expense | 33.33 | ||

| Miscellaneous expense | 7.5 | |||

| Cash | 40.83 | |||

| 17 | Bro Drawings | 3000 | ||

| Cash | 3000 | |||

| 18 | 14-Dec | Cash | 4000 | |

| Account Receivable | 4000 | |||

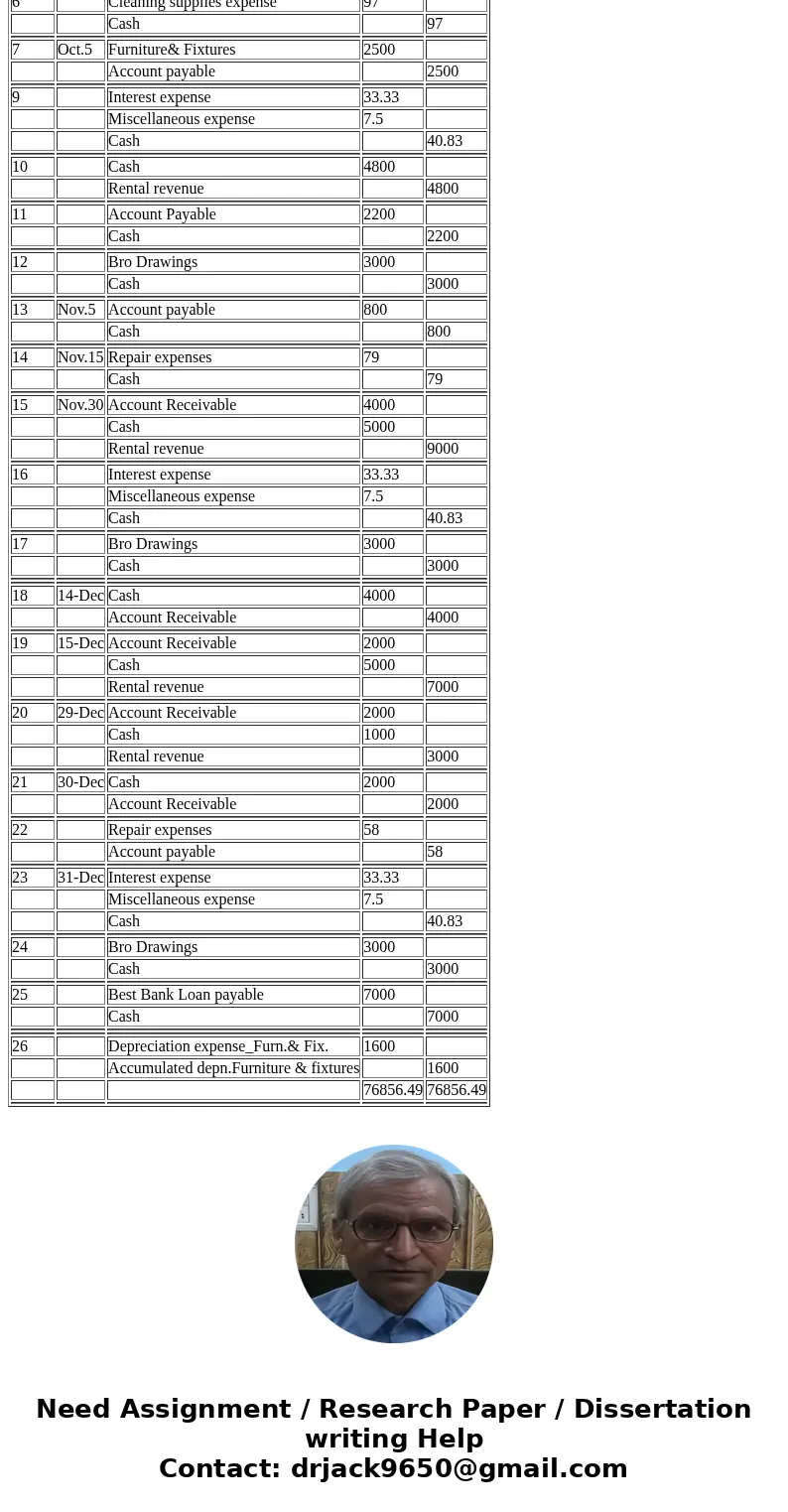

| 19 | 15-Dec | Account Receivable | 2000 | |

| Cash | 5000 | |||

| Rental revenue | 7000 | |||

| 20 | 29-Dec | Account Receivable | 2000 | |

| Cash | 1000 | |||

| Rental revenue | 3000 | |||

| 21 | 30-Dec | Cash | 2000 | |

| Account Receivable | 2000 | |||

| 22 | Repair expenses | 58 | ||

| Account payable | 58 | |||

| 23 | 31-Dec | Interest expense | 33.33 | |

| Miscellaneous expense | 7.5 | |||

| Cash | 40.83 | |||

| 24 | Bro Drawings | 3000 | ||

| Cash | 3000 | |||

| 25 | Best Bank Loan payable | 7000 | ||

| Cash | 7000 | |||

| 26 | Depreciation expense_Furn.& Fix. | 1600 | ||

| Accumulated depn.Furniture & fixtures | 1600 | |||

| 76856.49 | 76856.49 | |||

Homework Sourse

Homework Sourse