Q1 Luther Corporation Consolidated Balance Sheet December 31

Q1:

Luther Corporation

Consolidated Balance Sheet

December? 31, 2006 and 2005? (in $? millions)

Assets

2006

2005

Liabilities and

?Stockholders\' Equity

2006

2005

Current Assets

Current Liabilities

Cash

64

58.5

Accounts payable

85.4

73.5

Accounts receivable

56.2

39.6

Notes payable? /

shortminus?term

9.3

9.6

Inventories

46.6

42.9

Current maturities of

longminus?term

38.8

36.9

Other current assets

5.8

3.0

Other current liabilities

6.0

12.0

?????????????Total current assets

172.6

144.0

????????Total current liabilities

139.5

132.0

Longminus?Term

Longminus?Term

??Land

65

62.1

Longminus?term

239.1

168.9

??Buildings

106.4

91.5

??Capital lease obligations

??Equipment

116.5

99.6

??Less accumulated

??depreciation

?(56.2?)

?(52.5)

Deferred taxes

22.8

22.2

Net? property, plant, and

equipment

231.7

200.7

longminus?term

?

??

Goodwill

60.0

min??

longminus?term

261.9261.9

191.1

longminus?term

63.0

42.0

Total liabilities

401.4

323.1

longminus?term

354.7

242.7

?Stockholders\' Equity

125.9

63.6

Total Assets

527.3

386.7

Total liabilities and

?Stockholders\' Equity

527.3

386.7

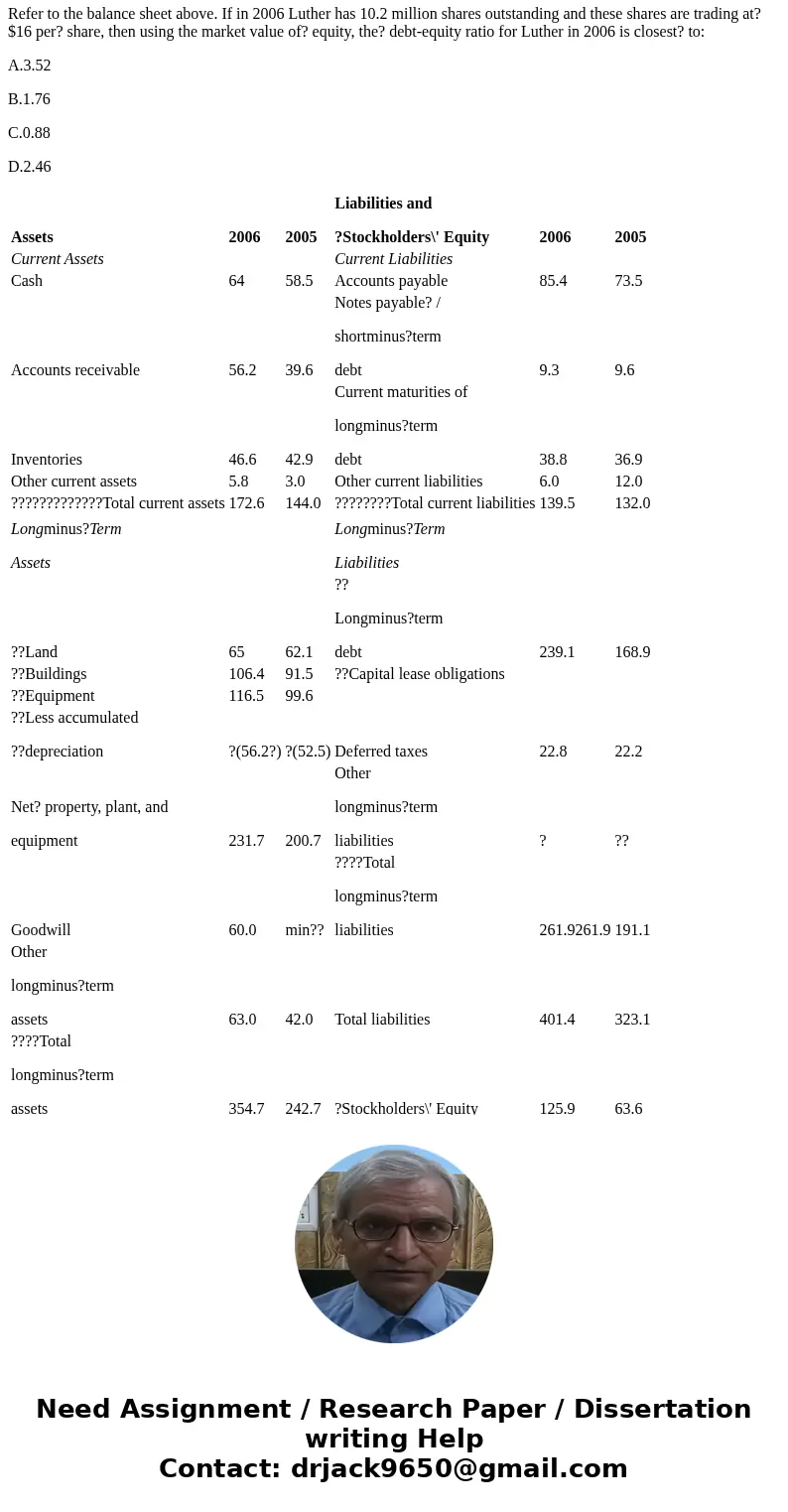

Refer to the balance sheet above. If in 2006 Luther has 10.2 million shares outstanding and these shares are trading at? $16 per? share, then using the market value of? equity, the? debt-equity ratio for Luther in 2006 is closest? to:

A.3.52

B.1.76

C.0.88

D.2.46

| Assets | 2006 | 2005 | Liabilities and ?Stockholders\' Equity | 2006 | 2005 |

| Current Assets | Current Liabilities | ||||

| Cash | 64 | 58.5 | Accounts payable | 85.4 | 73.5 |

| Accounts receivable | 56.2 | 39.6 | Notes payable? / shortminus?term debt | 9.3 | 9.6 |

| Inventories | 46.6 | 42.9 | Current maturities of longminus?term debt | 38.8 | 36.9 |

| Other current assets | 5.8 | 3.0 | Other current liabilities | 6.0 | 12.0 |

| ?????????????Total current assets | 172.6 | 144.0 | ????????Total current liabilities | 139.5 | 132.0 |

| Longminus?Term Assets | Longminus?Term Liabilities | ||||

| ??Land | 65 | 62.1 | ?? Longminus?term debt | 239.1 | 168.9 |

| ??Buildings | 106.4 | 91.5 | ??Capital lease obligations | ||

| ??Equipment | 116.5 | 99.6 | |||

| ??Less accumulated ??depreciation | ?(56.2?) | ?(52.5) | Deferred taxes | 22.8 | 22.2 |

| Net? property, plant, and equipment | 231.7 | 200.7 | Other longminus?term liabilities | ? | ?? |

| Goodwill | 60.0 | min?? | ????Total longminus?term liabilities | 261.9261.9 | 191.1 |

| Other longminus?term assets | 63.0 | 42.0 | Total liabilities | 401.4 | 323.1 |

| ????Total longminus?term assets | 354.7 | 242.7 | ?Stockholders\' Equity | 125.9 | 63.6 |

| Total Assets | 527.3 | 386.7 | Total liabilities and ?Stockholders\' Equity | 527.3 | 386.7 |

Solution

Debt typically includes long-term debts, short-term interest-bearing liabilities and the current portion of long-term debt.

Total Debt = Notes Payable + Current Maturities of Long-Term Debt + Long Term Debt = 9.3 + 38.8 + 239.1 = $ 287.2 million

Market Value of Equity = Price per Share x Shares Outstanding = 16 x 10.2 = $ 163.2 million

Debt to Equity Ratio = 287.2 / 163.2 = 1.759 or 1.76 approximately.

Hence, the correct option is (B).

Homework Sourse

Homework Sourse