First I will list all the work done so far for the workbook

First I will list all the work done so far for the workbook just in case the info is needed;

Day Care:

Total Variable Costs: $4.75

Total Fixed Costs: $859.39

Boarding:

Total Variable Costs: $7.36

Total Fixed Costs: $1,378.99

Grooming:

Total Variable Costs: $9.97

Total Fixed Costs: $2,367.92

now here are the instructions for what I need help with;

income statement:

and here is what I am missing;

2 Prepare the Contribution Margin per Unit and Contribution Margin Ratio 3 Grooming Day Care Boarding $ 25.00 5 Sales Price 6 Variable Cost per unit 7 Contribution Margin $25.00 $ 9.97 $15.03 Sales Price Variable Cost per unit Contribution Margin $ 18.00 S4.75 $ 13.25 Sales Price Variable Cost per unit Contribution Margin S 7.36 17.64 10 11 Contribution Margin Ratio 12 0.6012 0.7361111 0.7056Solution

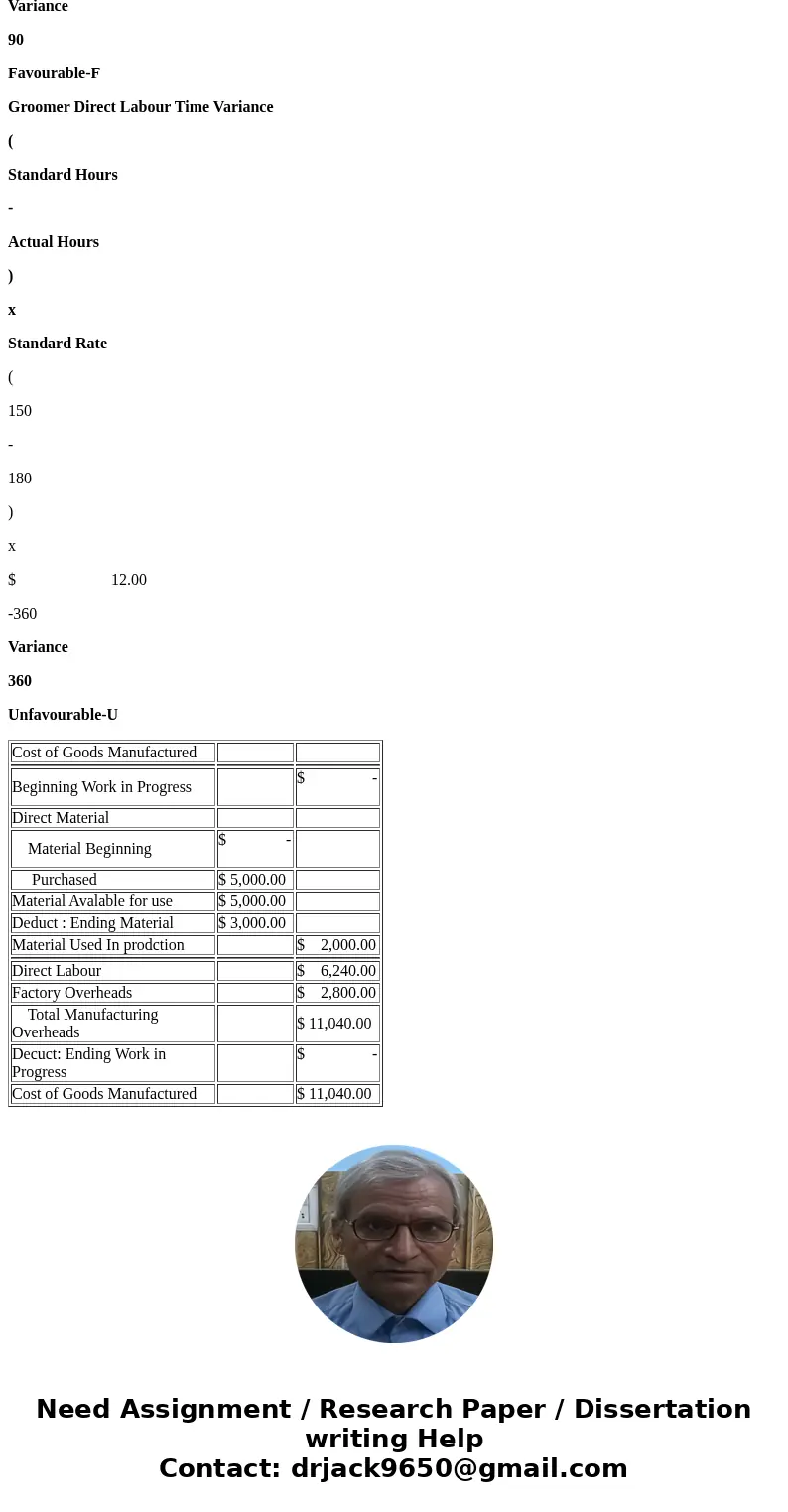

Cost of Goods Manufactured

Beginning Work in Progress

$ -

Direct Material

Material Beginning

$ -

Purchased

$ 5,000.00

Material Avalable for use

$ 5,000.00

Deduct : Ending Material

$ 3,000.00

Material Used In prodction

$ 2,000.00

Direct Labour

$ 6,240.00

Factory Overheads

$ 2,800.00

Total Manufacturing Overheads

$ 11,040.00

Decuct: Ending Work in Progress

$ -

Cost of Goods Manufactured

$ 11,040.00

Income Statement

For the Month Ended January 31st XXXX

Revenue

Grooming

$ 3,000.00

(30*4*25)

Daycare

11880

(30*22*18)

Boarding

9000

(30*12*25)

Total Revenue

$ 23,880.00

Cost of Goods Sold

$ 11,040.00

Gross Profit

$ 12,840.00

Expenses

Salaries

$ 1,200.00

Advertising

$ 100.00

Clearing Poducts

$ 120.00

Depreciation

$ 83.00

Rent

$ 650.00

Loan

$ 420.00

Utilities and Insurance

$ 600.00

Total Expenses

$ 3,173.00

Net income

$ 9,667.00

Notes

No information is given regarding opening material or opening and closing wip.they are assumed to be zero.

Cost of goods manufactured is cost of goods sold.

Actual DATA

Quantity (AQ)

Rate (AR)

Actual Cost

Direct Material

1200

$ 3.000

$ 3,600.00

Direct labor

180

$ 11.50

$ 2,070.00

Standard DATA

Quantity (SQ)

Rate (SR)

Standard Cost

Direct Material

1000

$ 2.000

$ 2,000.00

Direct labor

150

$ 12.00

$ 1,800.00

Direct Material Price Variance

(

Standard Rate

-

Actual Rate

)

x

Actual Quantity

(

$ 2.00

-

$ 3.00

)

x

1200

-1200

Variance

1200

Unfavourable-U

Material Quantity(Efficience) Variance

(

Standard Quantity

-

Actual Quantity

)

x

Standard Rate

(

1000

-

1200

)

x

$ 2.00

-400

Variance

400

Unfavourable-U

Groomer Direct Labor Rate Variance

(

Standard Rate

-

Actual Rate

)

x

Actual Labor Hours

(

$ 12.00

-

$ 11.50

)

x

180

90

Variance

90

Favourable-F

Groomer Direct Labour Time Variance

(

Standard Hours

-

Actual Hours

)

x

Standard Rate

(

150

-

180

)

x

$ 12.00

-360

Variance

360

Unfavourable-U

| Cost of Goods Manufactured | ||

| Beginning Work in Progress | $ - | |

| Direct Material | ||

| Material Beginning | $ - | |

| Purchased | $ 5,000.00 | |

| Material Avalable for use | $ 5,000.00 | |

| Deduct : Ending Material | $ 3,000.00 | |

| Material Used In prodction | $ 2,000.00 | |

| Direct Labour | $ 6,240.00 | |

| Factory Overheads | $ 2,800.00 | |

| Total Manufacturing Overheads | $ 11,040.00 | |

| Decuct: Ending Work in Progress | $ - | |

| Cost of Goods Manufactured | $ 11,040.00 |

Homework Sourse

Homework Sourse